Whether you’re an eCommerce store owner, a digital marketing enthusiast, or someone keen on optimizing operations, understanding how to calculate inventory turnover is crucial.

Imagine knowing exactly how fast you’re selling products and when to restock. That’s power!

You might wonder why this matters so much. Knowing how to calculate inventory turnover means strong sales; low turnover inventory could signal excess stock gathering dust—nobody wants that.

But let’s get real—figuring out the math can seem daunting at first glance. Don’t worry! We have easy steps to help you master this essential metric without sweat.

What Is Inventory Turnover?

Inventory turnover is often used in business, but what does it mean? Inventory turnover measures how quickly a company sells and replaces its inventory over time.

It’s a key metric for gauging a company’s inventory management efficiency and overall business performance.

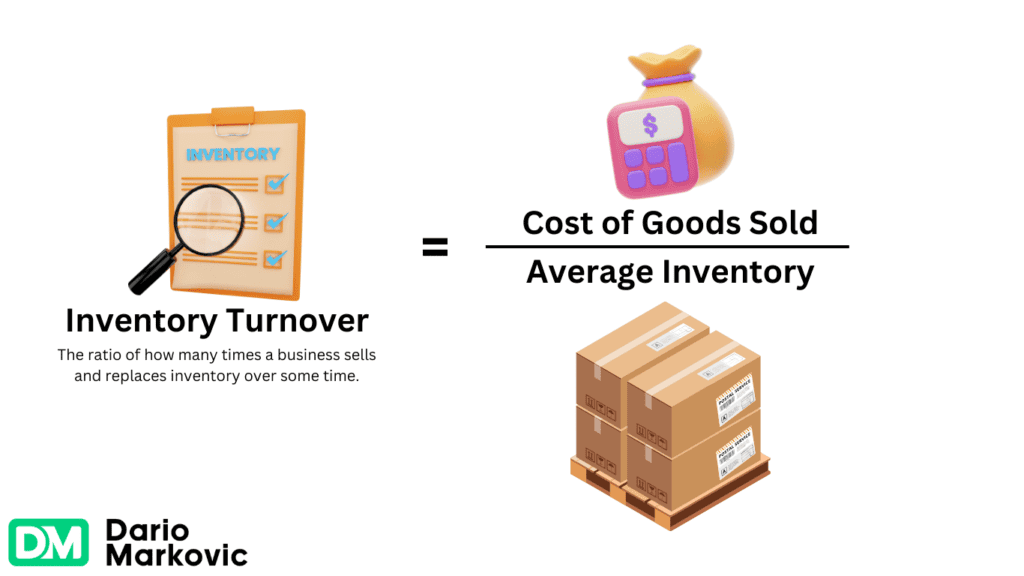

Definition of Inventory Turnover

Here’s the deal: inventory turnover is the number of times an inventory sold and replaced within a specific timeframe, usually a year.

It’s calculated by dividing your cost of goods sold (COGS) by your average inventory value for that period. This ratio reveals how effectively you manage your stock and generate sales from your inventory investment.

Importance of Inventory Turnover

Why should you care about knowing how to calculate inventory turnover? Because it’s a powerful indicator of your company’s financial health and operational efficiency.

A high turnover rate generally means selling products quickly and effectively, minimizing holding costs, and reducing the risk of obsolescence.

Conversely, a low turnover rate may signal weak sales, excess inventory, or inefficient purchasing practices.

Factors Affecting Inventory Turnover

It’s important to understand that inventory turnover isn’t a one-size-fits-all metric. It varies significantly across industries and is influenced by product type, demand patterns, and supply chain dynamics.

For example, fast-moving consumer goods (FMCG) companies typically have higher turnover rates due to the perishable nature of their products (also referred to as time-sensitive goods).

In contrast, luxury car dealerships may have lower ratios given the high value and slower inventory sales. Other factors impacting your inventory turnover include:

- Seasonality and market trends

- Supplier lead times and reliability

- Inventory management strategies (e.g., just-in-time vs. bulk ordering)

- Product life cycles and obsolescence risk.

The key is to benchmark your turnover ratio against industry standards and monitor it over time to identify trends and areas for improvement.

Optimizing your inventory turnover can free up working capital, improve cash flow, and boost your bottom line.

How to Calculate Inventory Turnover

Let’s dive into the nitty-gritty of learning how to calculate inventory turnover. The formula is pretty straightforward, but there are a few nuances to remember.

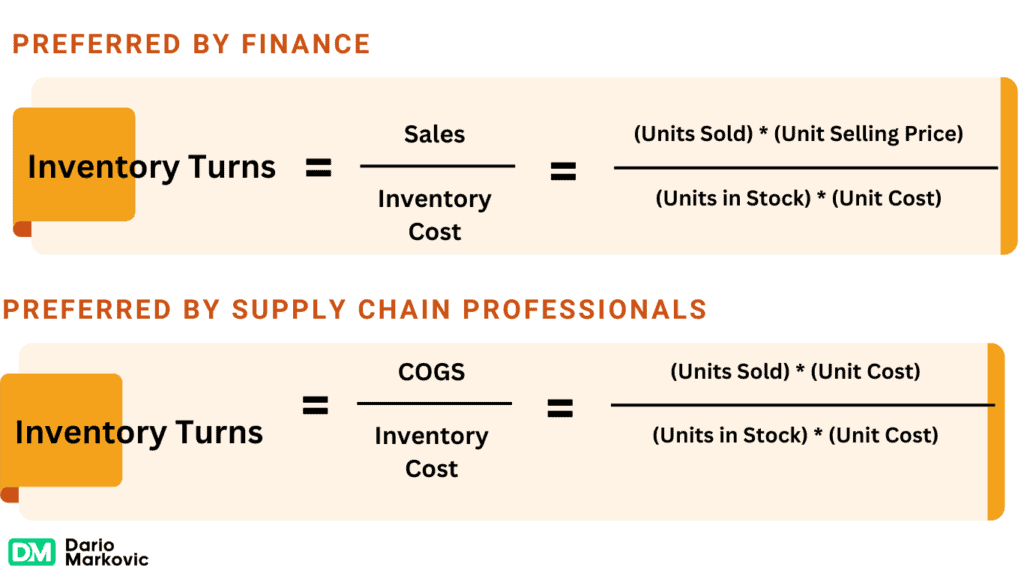

Inventory Turnover Formula

The inventory turnover formula is Inventory Turnover = Cost of Goods Sold (COGS) / Average Inventory.

Where: – COGS = Direct costs of producing and selling your products – Average Inventory = (Beginning Inventory + Ending Inventory) / 2

Calculating Cost of Goods Sold

To calculate your COGS, add all the direct costs of making and selling your products during the specific period.

This typically includes raw materials and supplies, direct labor costs, manufacturing overhead expenses, and freight and shipping costs.

You can find your COGS on your income statement or profit and loss (P&L) report.

Determining Average Inventory

Next, calculate your average inventory value for the same period. This is done by adding your beginning inventory balance (the value of your inventory at the start of the period) to your ending inventory balance (the value at the end of the period) and dividing the sum by two.

An average inventory value helps smooth out seasonal fluctuations or one-time events that may skew your high turnover ratios.

Example Turnover Calculation

Let’s say your company had the following financials for the past year: – COGS: $500,000 – Beginning Inventory: $100,000 – Ending Inventory: $150,000. To calculate your inventory turnover ratio:

1. Average Inventory = ($100,000 + $150,000) / 2 = $125,000

2. Inventory Turnover = $500,000 / $125,000 = 4

This means your company sells and replaces its inventory four times yearly. Whether this is good or bad depends on your industry benchmarks and historical performance. That is how to calculate inventory turnover.

Understanding Inventory Turnover Ratio

So, you’ve crunched the numbers and have your inventory turnover ratio in hand. Now what? It’s time to make sense of that sales figure and put it into context.

What is a Good Inventory Turnover Ratio?

The million-dollar question: what constitutes a “good” inventory turnover ratio?

The truth is that it varies widely by industry and business model. A ratio considered high for a furniture retailer might be alarmingly low for a grocery store chain.

Generally, higher inventory ratios are usually better, as they indicate you’re selling through your inventory quickly and efficiently.

However, excessive inventory could also mean you’re struggling to keep up with demand or risking stockouts—the more reason for an entrepreneur to know how to calculate inventory turnover.

High vs. Low Inventory Turnover

Simply put, a high inventory turnover ratio suggests your products are flying off the shelves, while a low ratio implies they’re collecting dust in your warehouse. High turnover is generally a good thing, as it means:

- Strong sales and effective marketing

- Efficient inventory management and purchasing

- Reduced holding costs and obsolescence risk

- Improved cash flow and liquidity.

On the other hand, low turnover can be a red flag, indicating:

- Weak demand or poor product-market fit

- Overstocking or inefficient purchasing practices

- Increased carrying costs and tied-up capital

- Higher risk of obsolescence or spoilage

Of course, these are broad generalizations, and there may be valid reasons for a low turnover ratio, such as intentional stockpiling ahead of a busy season or anticipated supply chain disruptions.

Industry Benchmarks

To understand the inventory turnover ratio, compare it to industry benchmarks. These can vary significantly based on product type, business model, and market dynamics.

According to CSIMarket, the financial performance metrics for the total market from Q1 2023 to Q1 2024 show notable improvements.

Revenue per employee increased from $409,596 to $573,999, and net income per employee rose from $44,170 to $54,791, indicating enhanced efficiency and profitability.

However, the receivable turnover ratio declined from 4.45 in Q4 2023 to 4.04 in Q1 2024, suggesting inadequate inventory differences.

The inventory turnover ratio based on sales improved significantly from 10.44 to 13.21, showing better inventory management, while the ratio based on the cost of sales fluctuated, ending at 9.07.

The asset turnover ratio also saw a slight improvement, from 0.25 to 0.27, reflecting better utilization of assets.

The key is to research benchmarks for your specific industry and niche and use them as a guideline for setting targets and evaluating performance.

Remember that these are averages; your optimal turnover ratio may be higher or lower depending on your unique business circumstances.

Benefits of Optimizing Inventory Turnover

Inventory optimization, including how to calculate inventory turnover, is about more than just a number on a spreadsheet. Improving your inventory turnover ratio can unlock many benefits for your business.

Reduced Carrying Costs

Every day, your unsold inventory is costing you money.

Optimizing your turnover days inventory helps minimize these carrying costs, such as warehouse rent and utilities, insurance and security expenses, the Opportunity cost of tied-up capital, and depreciation and obsolescence risk.

By reducing the time your inventory spends in storage, you can free up cash and space for more productive uses.

Improved Cash Flow

Cash is the lifeblood of any business, and inventory is often one of the biggest drains on your cash reserves. By increasing your inventory turnover rate, you can:

- Convert inventory into sales faster.

- Collect customer payments sooner.

- Reinvest profits into growth opportunities.

- Reduce reliance on external financing.

A healthy cash flow gives you the flexibility to seize sales opportunities, weather downturns, and invest in your business’s future.

Increased Sales

Optimizing your inventory turnover isn’t just about cutting costs – it can also help drive top-line growth.

By ensuring you always have the right products in stock when customers want them, you can reduce stockouts and lost sales, improve customer satisfaction and loyalty, capitalize on seasonal demand and market trends, and cross-sell and upsell complementary products.

Understanding how to improve inventory management is critical to maximizing sales and market share in today’s competitive landscape.

Better Customer Service

In the age of Amazon and same-day delivery, customer expectations for product availability and speed are higher than ever. By optimizing your inventory turnover, you can:

- Respond quickly to customer demands.

- Offer faster shipping and delivery times.

- Reduce back orders and wait times.

- Provide a seamless omnichannel experience.

Happy customers are loyal customers, and a streamlined inventory system is crucial for satisfying them.

Strategies to Improve Inventory Turnover

We’ve discussed the importance of knowing how to calculate inventory turnover and optimization benefits, but how do you improve your ratio? Here are some proven strategies.

Accurate Demand Forecasting

One of the biggest challenges in inventory management is predicting future demand. Overstocking can tie up cash and lead to obsolescence while understocking can result in lost sales and unhappy customers. The key is to use data-driven forecasting methods that consider factors like:

- Historical days sales trends and patterns

- Seasonality and promotional events

- Market trends and competitor activity

- Economic indicators and consumer sentiment

Accurately meet demand to optimize inventory levels and improve ideal turnover without sacrificing service levels.

Implementing Just-in-Time Inventory

Just-in-time (JIT) inventory is a lean management strategy that involves keeping minimal stock on hand. And replenish inventory only as needed. The goal is to reduce carrying costs and improve efficiency by aligning supply with actual demand. To implement JIT successfully, you need:

- Strong relationships with reliable suppliers

- Accurate demand forecasting and planning

- Efficient order processing and fulfillment systems

- Continuous monitoring and adjustment of stock levels

While JIT isn’t suitable for every business, it can be a powerful tool for improving inventory turnover inventory and cash flow in specific industries.

Identifying and Eliminating Dead Stock

Dead stock is the bane of any inventory manager’s existence. These products are unsellable due to obsolescence, damage, or lack of demand, and they can quickly eat into your profits and storage space. To identify and eliminate dead stock, you should:

- Regularly review and analyze inventory data.

- Identify slow-moving or non-moving items.

- Investigate the root causes of poor sales.

- Consider discounting, bundling, or donating dead stock.

- Adjust future purchasing to avoid repeat occurrences.

Proactively managing dead stock can free up valuable resources and improve your inventory turnover days.

Regular Inventory Audits

Even the best inventory management systems are prone to errors and discrepancies over time. Regular inventory audits are essential for maintaining inventory accuracy and efficiency. During an audit, you should:

- Physically count and verify inventory divided levels

- Reconcile counts with recorded data

- Investigate and resolve discrepancies

- Identify process improvements and training needs

- Update inventory records and financial statements.

By conducting periodic audits, you can catch issues early, prevent costly mistakes, and ensure your inventory turnover ratio inventory is based on accurate data.

Optimizing inventory turnover is an ongoing process that requires continuous monitoring, analysis, and adjustment.

By implementing these strategies and staying vigilant, you can unlock the many benefits of efficient inventory management and take your business to the next level.

Conclusion

The Hollywood version of AI may have painted robots as villains ready to take over the world, but calculating inventory turnover? It’s practical business sense!

You’ve learned the basics of knowing how to calculate inventory turnover. This knowledge isn’t about surviving a dystopian future; it’s about thriving in today’s market.

If you’re looking for sustainable growth through better management practices, keep these calculations handy for inventory turnover ratio inventory—they’re tools you’ll return to repeatedly.