Learn How To Secure E-commerce Funding

So, you can’t make money with no money. This paradox leads you to think: how to secure e-commerce funding?

As an e-commerce entrepreneur, securing funding is a crucial step in growing your business. Whether you’re just starting out or looking to scale, having access to the right funding can make all the difference. In this blog, we’ll provide you with a step-by-step guide on how to secure e-commerce funding, along with examples, tools, tips, and tricks to help you succeed.

Securing E-commerce Funding: Key Takeaways

Develop a solid business plan: A well-researched and well-written business plan is essential for securing e-commerce funding. It should outline your business’s mission, vision, market analysis, competitive analysis, marketing and sales strategy, financial projections, and management team.

Explore alternative funding options: Ecommerce businesses have various funding options beyond traditional bank loans, such as venture capital, crowdfunding, ecommerce loans, and grant programs. It’s essential to understand the pros and cons of each option and choose the best fit for your business.

Prepare a compelling pitch and financial package: To secure funding, you need to present a clear, concise, and compelling pitch. Prepare a comprehensive financial package, including a balance sheet, income statement and break-even analysis, to demonstrate your business’s potential.

Step 1: Prepare Your Business

Before applying for funding, it’s essential to have a solid business plan in place. This includes:

- A clear and concise business model

- A detailed financial plan, including projected revenue and expenses

- A marketing strategy

- A competitive analysis

- A team management plan

Tools to help:

- LivePlan: A business planning software that helps you create a comprehensive business plan.

- Google Sheets: A free online spreadsheet tool to help you create and manage your financial plan.

Step 2: Explore Funding Options

There are several funding options available for ecommerce businesses, including:

- Venture Capital (VC): Investment from VC firms in exchange for equity.

- Angel Investors: Investment from individual investors in exchange for equity.

- Crowdfunding: Raising small amounts of money from a large number of people, typically through online platforms.

- Small Business Administration (SBA) Loans: Government-backed loans with favorable terms.

- Alternative Lending: Online lenders that offer faster and more flexible funding options.

- Inventory Financing: Funding specifically for inventory purchases.

- Drop Shipping Financing: Funding for drop shipping businesses.

Examples:

- Warby Parker: Secured VC funding to scale their e-commerce business.

- Kickstarter: A popular crowdfunding platform for e-commerce startups.

Step 3: Improve Your Credit Score

A good credit score can significantly improve your chances of securing funding. Here are some tips to improve your credit score:

- Pay bills on time: Late payments can negatively affect your credit score.

- Keep credit utilization low: Keep your credit card balances below 30% of the limit.

- Monitor your credit report: Check for errors and dispute them if necessary.

Tools to help:

- Credit Karma: A free online tool to monitor your credit score and report.

- Experian: A credit reporting agency that offers credit score monitoring and improvement tools.

Step 4: Build a Strong Online Presence

A professional online presence can help you appear more credible to potential investors. This includes:

- A well-designed website: Showcase your products and brand story.

- Active social media: Engage with customers and promote your brand.

- Positive customer reviews: Encourage customers to leave reviews on your website or social media.

Tools to help:

- Shopify: A popular ecommerce platform to build and design your website.

- Hootsuite: A social media management tool to schedule and track your posts.

Step 5: Network and Build Relationships

Building relationships with potential investors, partners, and mentors can help you secure funding. Attend industry events, join online communities, and connect with people on LinkedIn.

Examples:

- Ecommerce Fuel: A community of ecommerce entrepreneurs that offers networking opportunities and funding resources.

- LinkedIn Groups: Join ecommerce-focused groups to connect with potential investors and partners.

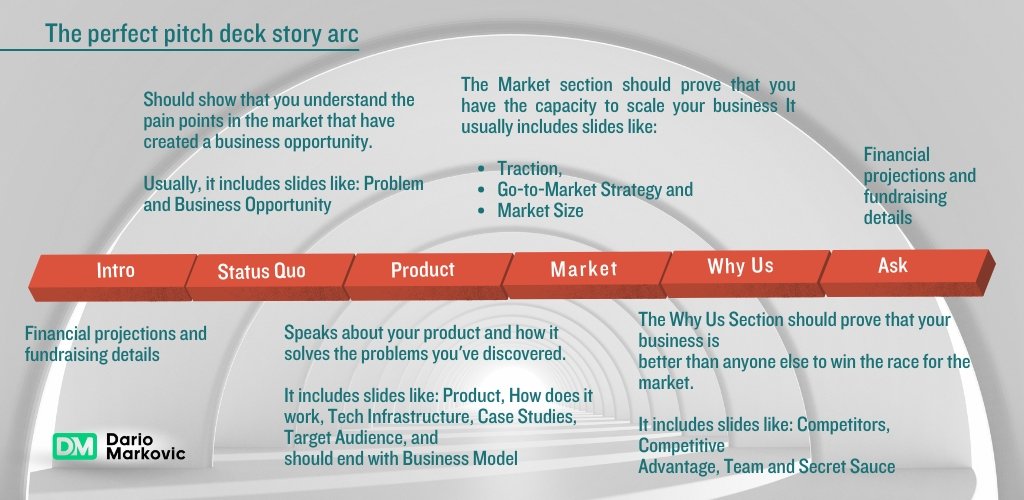

Step 6: Create a Strong Pitch

When applying for funding, you’ll need to create a strong pitch that showcases your business and its potential. This includes:

- A clear and concise elevator pitch: A 30-second summary of your business.

- A detailed pitch deck: A presentation that outlines your business plan and financials.

- A persuasive funding request: Clearly state how you plan to use the funding and what return on investment (ROI) you expect.

Tools to help:

- PitchDeck: A free online tool to create a professional pitch deck.

- Slidedocs: A presentation software that helps you create engaging pitch decks.

Tips and Tricks:

- Start small: Don’t try to secure too much funding at once. Start with smaller amounts and scale up as your business grows.

- Be prepared: Make sure you have all the necessary documents and information ready when applying for funding.

- Be flexible: Be open to different funding options and terms.

- Follow up: After applying for funding, follow up with the lender or investor to show your interest and commitment.

Securing ecommerce funding requires preparation, persistence, and creativity. By following these steps, using the right tools, and staying focused, you can increase your chances of securing the funding you need to grow your business. Remember to stay flexible, be prepared, and follow up to ensure success.

Time-Wasting Paths to Avoid When Securing E-commerce Funding

Path 1: Applying for Traditional Bank Loans without a Strong Credit History

Traditional bank loans can be a viable option for ecommerce funding, but they often require a strong credit history and a solid financial track record. If you have a poor credit score or limited financial history, applying for a traditional bank loan can be a time-consuming and demotivating experience.

Why it’s a time-waster: Bank loan applications can take weeks or even months to process, and the chances of rejection are high if you don’t meet the lender’s strict criteria.

Path 2: Chasing After Free Money

While free money sounds appealing, it’s often an unrealistic expectation. Grants, contests, and other “free money” opportunities are highly competitive, and the odds of securing funding are low.

Why it’s a time-waster: Researching and applying for free money opportunities can be a significant time drain, taking away from more productive activities like building your business or exploring alternative funding options.

Path 3: Focusing on a Single Funding Option

Putting all your eggs in one basket can be a recipe for disaster. Focusing on a single funding option, such as venture capital or crowdfunding, can lead to disappointment and wasted time if that option doesn’t pan out.

Why it’s a time-waster: Diversifying your funding options can increase your chances of securing funding. By exploring multiple paths, you can create a backup plan and avoid putting all your hopes on a single opportunity.

Path 4: Not Having a Clear Business Plan

A clear business plan is essential for securing funding. Without a solid plan, you’ll struggle to convince investors or lenders that your business is worth investing in.

Why it’s a time-waster: A poorly prepared business plan can lead to rejection, and revising your plan can be a time-consuming process. Taking the time to develop a solid business plan upfront will save you time and energy in the long run.

Path 5: Not Building a Strong Online Presence

A professional online presence is crucial for attracting investors and lenders. A poorly designed website, inactive social media, and lack of customer reviews can raise red flags.

Why it’s a time-waster: Building a strong online presence takes time and effort. Neglecting this crucial aspect of your business can lead to wasted time and opportunities, as investors and lenders may view your business as unprofessional or unreliable.

Path 6: Not Networking and Building Relationships

Networking and building relationships with potential investors, partners, and mentors can help you secure funding. Failing to do so can limit your access to valuable connections and opportunities.

Why it’s a time-waster: Attending industry events, joining online communities, and connecting with people on LinkedIn can help you build a strong network. Neglecting these opportunities can lead to wasted time and missed connections.

Strategize, Plan, Execute

Securing e-commerce funding requires a strategic approach. By avoiding these time-wasting paths, you can focus on more productive activities that will help you grow your business. Remember to diversify your funding options, build a strong online presence, and network with potential investors and partners.

By doing so, you’ll increase your chances of securing the funding you need to take your e-commerce business to the next level.

The Art of Crafting a Compelling Pitch: Insights, Tips, and Stats

A well-crafted pitch is a crucial component of securing funding, partnerships, or investments for your ecommerce business. A good pitch can make or break your chances of success, and it’s essential to get it right. In this article, we’ll dive into the anatomy of a compelling pitch, provide tips and insights, and share some stats to help you create a pitch that resonates with your audience.

What Makes a Good Pitch?

A good pitch is one that effectively communicates your business idea, showcases your unique value proposition, and demonstrates your potential for growth and returns. Here are the essential elements of a compelling pitch:

- Clear and concise value proposition: Clearly articulate your business’s unique value proposition and how it solves a specific problem or meets a particular need.

- Compelling story: Share a narrative that resonates with your audience, highlighting your business’s mission, vision, and goals.

- Market opportunity: Showcase the size and growth potential of your target market, and highlight your competitive advantages.

- Traction and progress: Share your business’s achievements, milestones, and progress to date.

- Financial projections: Provide realistic and conservative financial projections, highlighting your revenue growth potential and return on investment.

- Competitive differentiation: Highlight what sets your business apart from competitors and how you plan to maintain your competitive edge.

Strong call-to-action: End with a clear call-to-action, outlining what you’re asking for and how you plan to use the funding or support.

Tips and Insights

- Keep it concise: Aim for a pitch that’s 10-15 minutes long, with 10-15 slides.

- Use storytelling techniques: People remember stories more than facts and figures, so incorporate narratives and anecdotes to make your pitch more engaging.

- Show, don’t tell: Use visual aids, demos, or prototypes to demonstrate your product or service, rather than just talking about it.

- Practice, practice, practice: Rehearse your pitch until it feels natural and confident.

- Customize your pitch: Tailor your pitch to your audience, highlighting the aspects of your business that are most relevant to them.

- Be authentic and passionate: Show your audience that you’re genuinely passionate about your business and its mission.

- Anticipate questions: Prepare for common questions and concerns, and have clear, concise responses ready.

Statistics

- 55% of investors say that a strong pitch is the most important factor in their decision to invest. (Source: CB Insights)

- 67% of startup founders said that their pitch deck was the most critical factor in securing funding. (Source: PitchBook)

- The average attention span of an investor is around 3-5 minutes, so make sure your pitch is engaging and concise. (Source: Harvard Business Review)

- 75% of investors said that a pitch that’s too long or too complex is a major turn-off. (Source: VentureBeat)

- The top three reasons startups fail to secure funding are:

- Lack of traction (42%)

- Poor team dynamics (23%)

- Uncompetitive market (17%) (Source: CB Insights)

Crafting a Winning Pitch

Here’s a sample outline for a compelling pitch:

Slide 1: Introduction

- Introduce yourself and your business

- Clearly state your business’s mission and vision

Slide 2-3: Problem Statement

- Identify the problem or need your business solves

- Highlight the market opportunity and potential

Slide 4-5: Solution Overview

- Introduce your product or service

- Highlight its unique features and benefits

Slide 6-7: Market Opportunity

- Showcase the size and growth potential of your target market

- Highlight your competitive advantages

Slide 8-9: Traction and Progress

- Share your business’s achievements and milestones

- Highlight your progress to date

Slide 10-11: Financial Projections

- Provide realistic and conservative financial projections

- Highlight your revenue growth potential and return on investment

Slide 12-13: Competitive Differentiation

- Highlight what sets your business apart from competitors

- Outline your plan to maintain your competitive edge

Slide 14-15: Call-to-Action

- Clearly state what you’re asking for and how you plan to use the funding or support

- End with a strong call-to-action and a sense of urgency

By following these tips, insights, and stats, you’ll be well on your way to crafting a compelling pitch that resonates with your audience and helps you secure the funding or support you need to grow your ecommerce business.

Wrapping It Up

As a business owner and manager, I’ve faced the challenge of securing ecommerce funding multiple times. Through trial and error, I’ve learned some valuable lessons that I’d like to share with you.

First, have a solid business plan in place. It’s the foundation of your funding request, and it’s crucial to demonstrate a clear understanding of your business model, market opportunity, and financial projections.

Explore alternative funding options beyond traditional bank loans, such as venture capital, angel investors, crowdfunding, ecommerce loans, and grant programs. Each has its pros and cons, so understand the terms and negotiate wisely.

When pitching, clearly articulate your unique value proposition, market opportunity, traction, and financial projections. Be concise, engaging, and passionate about your business.

Securing ecommerce funding takes time and perseverance. Don’t get discouraged by rejection, and be open to feedback and guidance from others.

From my experience, I’ve learned that securing ecommerce funding is a challenging but crucial step in growing a successful online business. By following these key takeaways, you’ll be well on your way to securing the capital you need to take your business to the next level.

FAQ

E-commerce funding refers to the process of securing financial support to start, grow, or scale an online business. You may need ecommerce funding to cover startup costs, inventory, marketing, or expansion expenses.

There are several e-commerce funding options, including venture capital, angel investors, crowdfunding, e-commerce loans, grant programs, and traditional bank loans.

Venture capital is a type of investment where a firm or individual invests money in exchange for equity in your business. Venture capitalists typically take an active role in guiding your business.

Angel investors are high-net-worth individuals who invest their own money in startups in exchange for equity. They often have a more hands-off approach than venture capitalists.

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms like Kickstarter or Indiegogo.

E-commerce loans are specialized loans designed for online businesses, often with more flexible terms and faster approval processes than traditional bank loans.

Grant programs provide free money to entrepreneurs, often with specific requirements or restrictions. Eligibility varies depending on the program.

A solid business plan should include a market analysis, competitive analysis, marketing and sales strategy, financial projections, and management team overview.

You’ll need to prepare a balance sheet, income statement, cash flow statement, and break-even analysis, as well as any other financial documents required by the funding option.

A compelling pitch should clearly articulate your business’s unique value proposition, market opportunity, traction, and financial projections, and demonstrate your passion and expertise.

Each funding option has its own advantages and disadvantages, such as equity dilution, interest rates, and repayment terms.

The funding process can take anywhere from a few weeks to several months, depending on the funding option and the complexity of the application.

Eligibility criteria vary depending on the funding option, but often include factors such as business age, revenue, profitability, and creditworthiness.

The amount of funding you can expect to receive varies widely depending on the funding option, your business’s needs, and the lender’s or investor’s criteria.

Repayment terms and interest rates vary depending on the funding option, but can include fixed or variable interest rates, monthly or quarterly payments, and repayment terms ranging from a few months to several years.