E-commerce venture capital firms are pivotal players in the landscape of online retail, providing essential funding and support to startups and established businesses alike.

As the e-commerce sector continues to expand, these firms are increasingly focused on identifying and nurturing innovative companies that can thrive in this competitive environment.

E-commerce Venture Capital Firms: 3 Point Summary

E-commerce Growth and Investment Opportunities: The e-commerce market has seen tremendous growth in recent years, with global sales projected to reach over $7 trillion by 2025. This rapid expansion has attracted significant venture capital investment, with many firms focusing on innovative startups that leverage technology to enhance the online shopping experience.

Success Stories of E-commerce Startups: Notable examples such as Warby Parker and Glossier illustrate how e-commerce venture capital firms can propel businesses to success. Warby Parker disrupted the eyewear market with a direct-to-consumer model, while Glossier built a community-driven beauty brand, both achieving valuations in the billions through strategic investments.

Navigating the Venture Capital Landscape: Aspiring investors and entrepreneurs are encouraged to conduct thorough market research, build networks, gain relevant experience, and develop clear investment theses. By understanding both sides of the investment equation, individuals can effectively participate in the dynamic world of e-commerce venture capital.

The Role of E-commerce Venture Capital Firms

E-commerce venture capital firms specialize in investing in businesses that operate online retail platforms or provide services that enhance the e-commerce experience. Their investments often target a range of sectors within e-commerce, including direct-to-consumer brands, marketplace platforms, logistics solutions, and technology providers that facilitate online transactions.

Investment Strategies

E-commerce venture capital firms typically employ various strategies to maximize their returns:

- Early-Stage Investments: Many firms focus on seed and Series A funding rounds, providing the necessary capital for startups to develop their products and establish market presence.

- Growth Capital: Some firms invest in more mature companies looking to scale operations, expand product lines, or enter new markets.

- Sector Specialization: Certain firms concentrate on specific niches within e-commerce, such as fashion, food delivery, or health products, allowing them to leverage industry expertise.

Key Players in E-commerce Venture Capital

Several prominent e-commerce venture capital firms have made significant impacts in the industry:

- Andreessen Horowitz: Known for its substantial investments in technology-driven companies, Andreessen Horowitz has backed several successful e-commerce ventures. Their approach combines deep industry knowledge with a robust network of resources.

- Sequoia Capital: This firm has a long history of investing in disruptive e-commerce businesses. Sequoia’s strategy often involves providing not just capital but also strategic guidance to help companies navigate growth challenges.

- Accel Partners: Accel focuses on early-stage investments and has a strong track record in the e-commerce space. Their portfolio includes several high-profile companies that have transformed the retail landscape.

Trends Shaping E-commerce Venture Capital

The landscape of e-commerce venture capital is continually evolving. Here are some current trends:

Sustainability and Ethical Practices

Investors are increasingly looking for businesses that prioritize sustainability and ethical practices. Companies that demonstrate a commitment to environmental responsibility are more likely to attract funding from e-commerce venture capital firms.

Technological Innovation

With advancements in artificial intelligence, machine learning, and blockchain technology, e-commerce venture capital firms are keen on investing in startups that leverage these technologies to enhance customer experiences and streamline operations.

Global Expansion

As e-commerce continues to grow globally, venture capital firms are exploring opportunities beyond traditional markets. Investments in emerging markets present unique challenges and rewards, prompting firms to adapt their strategies accordingly.

Challenges Faced by E-commerce Venture Capital Firms

Despite the opportunities present in the e-commerce sector, venture capital firms encounter several challenges:

- Market Saturation: With numerous players entering the market, distinguishing between viable startups and those likely to fail becomes increasingly difficult.

- Consumer Behavior Changes: Rapid shifts in consumer preferences can impact the success of invested companies. Firms must stay attuned to market trends to make informed investment decisions.

- Regulatory Environment: Navigating the complex regulatory landscape governing online commerce can pose challenges for both investors and their portfolio companies.

E-commerce venture capital firms play a crucial role in fostering innovation within the online retail space. By providing financial backing and strategic support, they enable startups and established businesses to thrive amidst competition and market fluctuations.

As trends continue to evolve, these firms will need to adapt their strategies while remaining focused on identifying the next wave of successful e-commerce ventures.

E-commerce Venture Capital Firms: An In-Depth Analysis

The rise of e-commerce has transformed the retail landscape, creating a fertile ground for innovation and investment. E-commerce venture capital firms play a crucial role in this ecosystem, providing the necessary funding and support to startups and established businesses looking to thrive in the digital marketplace.

This chapter explores the dynamics of e-commerce venture capital, supported by relevant statistics and insights.

The Growing E-commerce Market

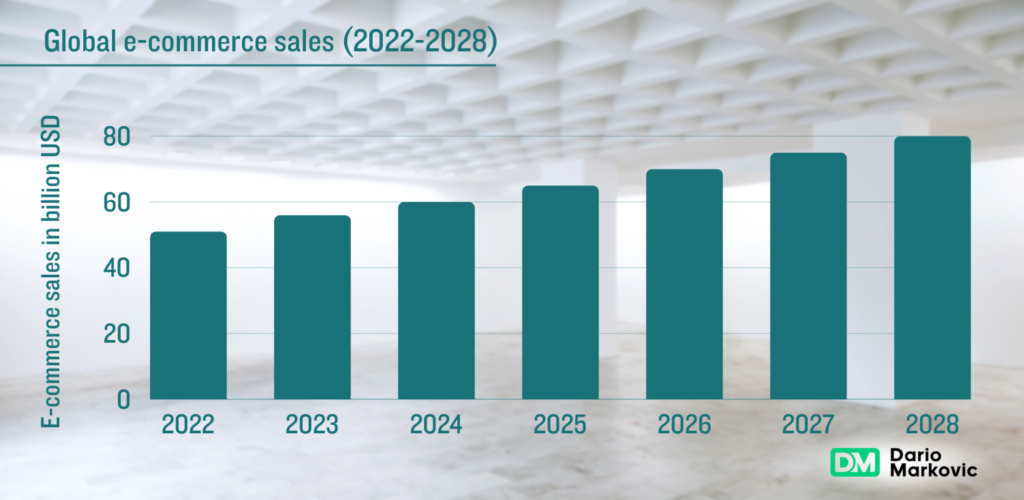

E-commerce has experienced exponential growth over the past decade. According to Statista, global e-commerce sales reached approximately \$5.2 trillion in 2021 and are projected to grow to \$6.4 trillion by 2024. This rapid expansion reflects a significant shift in consumer behavior, with more people opting for online shopping due to convenience and accessibility.

Key Statistics

- Market Penetration: As of 2023, e-commerce accounts for about 19% of total retail sales worldwide, up from just 13% in 2019.

- Mobile Commerce: Mobile commerce is a driving force behind this growth, with mobile devices accounting for over 50% of all e-commerce sales in recent years.

- Consumer Preferences: A survey by McKinsey revealed that 75% of consumers have tried new shopping behaviors during the pandemic, with many intending to continue these habits post-pandemic.

The Role of E-commerce Venture Capital Firms

E-commerce venture capital firms focus on investing in businesses that operate within the online retail space or provide essential services that enhance e-commerce operations. Their investments are critical for fostering innovation and supporting startups that can disrupt traditional retail models.

Investment Focus Areas

- Direct-to-Consumer (DTC) Brands: Many firms are investing heavily in DTC brands that bypass traditional retail channels to sell directly to consumers.

- Marketplace Platforms: Investment in platforms like Amazon and Alibaba continues to be robust as these marketplaces dominate online sales.

- Logistics and Supply Chain Solutions: With the increase in online orders, logistics firms that can optimize delivery processes are becoming attractive investment targets.

The Role of E-commerce Venture Capital Firms

E-commerce venture capital firms focus on investing in businesses that operate within the online retail space or provide essential services that enhance e-commerce operations. Their investments are critical for fostering innovation and supporting startups that can disrupt traditional retail models.

Investment Focus Areas

- Direct-to-Consumer (DTC) Brands: Many firms are investing heavily in DTC brands that bypass traditional retail channels to sell directly to consumers.

- Marketplace Platforms: Investment in platforms like Amazon and Alibaba continues to be robust as these marketplaces dominate online sales.

- Logistics and Supply Chain Solutions: With the increase in online orders, logistics firms that can optimize delivery processes are becoming attractive investment targets.

Notable E-commerce Venture Capital Firms

Several e-commerce venture capital firms have established themselves as leaders in this space:

- Andreessen Horowitz: Known for its substantial investments in technology-driven companies, it has backed several successful e-commerce ventures.

- Sequoia Capital: This firm has a long history of investing in disruptive e-commerce businesses, focusing on both early-stage startups and growth capital.

- Accel Partners: Accel is recognized for its early-stage investments and has a strong track record in the e-commerce sector.

Investment Trends:

- Increased Funding Amounts: In 2021 alone, venture capital funding for e-commerce startups reached approximately $30 billion, reflecting a growing interest from investors.

- Diversity of Investments: Ecommerce venture capital firms are diversifying their portfolios by investing in various niches within the sector, including health products, fashion, and food delivery services.

Challenges Facing Ecommerce Venture Capital Firms

While the opportunities within e-commerce are significant, venture capital firms face several challenges:

Market Saturation

As more players enter the market, distinguishing between viable startups and those likely to fail becomes increasingly difficult. A report from PitchBook indicated that nearly 80% of venture-backed startups do not return their initial investment.

Rapidly Changing Consumer Behavior

Consumer preferences can shift quickly, making it challenging for firms to predict which businesses will succeed. According to Deloitte, nearly 60% of consumers switched brands during the pandemic due to changing needs and preferences.

Regulatory Environment

The regulatory landscape governing online commerce is complex and varies significantly across regions. Firms must navigate these regulations carefully to avoid potential pitfalls.

Ecommerce venture capital firms are integral to the growth and innovation of the online retail sector. As e-commerce continues to evolve, these firms will play a critical role in identifying promising startups and providing them with the resources needed to succeed. With a keen eye on market trends and consumer behavior, ecommerce venture capitalists are poised to capitalize on the ongoing transformation of retail, ensuring they remain at the forefront of this dynamic industry.

The future of ecommerce is bright, with significant opportunities for both investors and entrepreneurs willing to adapt and innovate in an ever-changing landscape.

27 Firms: The Big Players

Here is a list of 27 prominent ecommerce venture capital firms, including basic information about their operations, investment focus, and other relevant details.

| Firm Name | Number of Employees | Estimated Net Worth | Investment Focus | How They Find Investments |

|---|---|---|---|---|

| Andreessen Horowitz | 200+ | $35 billion | Tech startups, including e-commerce | Networking, referrals, industry events |

| Sequoia Capital | 200+ | $20 billion | Early-stage and growth-stage companies | Direct outreach, industry connections |

| Accel Partners | 100+ | $10 billion | Consumer internet, software, and e-commerce | Conferences, startup competitions |

| Benchmark Capital | 10-20 | $3 billion | Personal networks, referrals | Bessemer Venture Partners |

| Bessemer Venture Partners | 100+ | $5 billion | SaaS, consumer products, and ecommerce | Market research, industry events |

| Forerunner Ventures | 30+ | $1.5 billion | DTC brands and consumer-focused startups | Community engagement, social media |

| Union Square Ventures | 20+ | $1 billion | Internet services and e-commerce | Networking within tech communities |

| Kleiner Perkins | 100+ | $10 billion | Technology-driven companies | Industry events, referrals |

| Insight Partners | 300+ | $30 billion | Growth-stage software and e-commerce | Proprietary research, networking |

| Tiger Global Management | 200+ | $65 billion | Public and private companies in tech | Market analysis, direct outreach |

| SoftBank Vision Fund | 100+ | $100 billion | Tech startups globally | Global scouting network |

| Lerer Hippeau | 30+ | $1 billion | Early-stage consumer brands | Referrals from founders and industry experts |

| Lightspeed Venture Partners | 100+ | $10 billion | Consumer and enterprise technology | Conferences, networking |

| NEA (New Enterprise Associates) | 200+ | $20 billion | Diverse sectors including e-commerce | Direct outreach, partnerships |

| Canaan Partners | 50+ | $1.5 billion | Early-stage healthcare and technology | Networking events, startup competitions |

| Greylock Partners | 50+ | $3 billion | Consumer tech and enterprise software | Industry conferences, personal networks |

| Foundry Group | 30+ | $1 billion | Early-stage tech startups | Community engagement, industry events |

| Bullpen Capital | 10-20 | $500 million | Late-stage venture investments | Market research, referrals |

| Index Ventures | 100+ | $6 billion | Technology and consumer brands | Networking within tech ecosystems |

| General Catalyst | 100+ | $4.5 billion | Consumer and enterprise technology | Direct outreach to founders |

| Felicis Ventures | 20+ | $1.2 billion | Diverse sectors including ecommerce | Networking events, personal connections |

| UpWest Labs | 10-20 | $200 million | Israeli startups in the US | Partnerships with Israeli tech organizations |

| Social Capital | 50+ | $1.5 billion | Healthtech, fintech, and consumer products | Research-driven approach |

| RRE Ventures | 30+ | $800 million | Technology-focused startups | Industry networking |

| Bullpen Capital | 10-20 | $500 million | Late-stage venture investments | Market research, referrals |

Summary of Key Information

- Most of these firms have a significant number of employees ranging from small teams (10-20) to larger organizations (300+) that allow them to manage multiple investments effectively.

- The estimated net worth of these firms varies widely from hundreds of millions to over a hundred billion dollars.

- Their investment focus typically includes a mix of early-stage startups to growth-stage companies across various sectors within the ecommerce landscape.

- Many firms utilize networking within the industry, referrals from trusted sources, attendance at conferences and startup competitions to identify potential investment opportunities.

This list provides a snapshot of the major players in the ecommerce venture capital space and highlights their operations and strategies for finding promising startups to invest in.

E-commerce Venture Capital Firms: Real-Life Examples and Impact

E-commerce venture capital firms are not just abstract entities in the financial world; they are instrumental in shaping the future of retail by investing in innovative startups. This chapter explores real-life examples of successful investments, the stories behind them, and the broader implications for the e-commerce landscape.

The Rise of Warby Parker

One of the most notable success stories in the e-commerce sector is Warby Parker, an online eyewear retailer that disrupted the traditional eyewear market. Founded in 2010, Warby Parker aimed to provide affordable, stylish glasses while also addressing a social issue: for every pair sold, a pair is distributed to someone in need.

Investment Journey

Warby Parker’s initial funding came from a group of angel investors, but as the company grew, it attracted attention from prominent venture capital firms. In 2011, it raised $1.5 million in seed funding led by First Round Capital and later secured additional rounds from firms like Accel Partners and Tiger Global Management. By 2021, Warby Parker had reached a valuation of over $3 billion, demonstrating how effective venture capital can fuel growth and innovation.

Impact on the Market

Warby Parker’s success has inspired a wave of DTC brands across various sectors, encouraging entrepreneurs to explore e-commerce as a viable business model. The company’s approach to customer experience—offering virtual try-ons and home try-on programs—has set new standards for online retail.

Glossier: The Beauty Brand Revolution

Another compelling example is Glossier, a beauty brand that emerged from the beauty blog Into The Gloss. Founded in 2014 by Emily Weiss, Glossier quickly became known for its minimalist products and strong community engagement.

Funding Milestones

Glossier’s journey began with a seed round of $2 million from investors including Forerunner Ventures. Subsequent funding rounds saw Glossier raise over $86 million, with investments from firms like Accel Partners and IVP. By 2021, Glossier was valued at approximately $1.8 billion, showcasing the potential for e-commerce brands to achieve significant market presence.

Community-Centric Approach

Glossier’s emphasis on customer feedback and community involvement has reshaped how beauty brands engage with consumers. By leveraging social media and direct communication with customers, Glossier has cultivated a loyal following that drives sales and brand advocacy.

The Logistics Revolution: Flexport

While many ecommerce venture capital firms focus on consumer brands, others are investing in logistics solutions that support e-commerce growth. A prime example is Flexport, a technology-driven freight forwarder that simplifies global trade logistics.

Investment Growth

Founded in 2013, Flexport raised its first significant round of funding—$10 million—in 2014 from investors like Founders Fund. As demand for efficient logistics solutions surged during the e-commerce boom, Flexport attracted further investments totaling over $1 billion, with a valuation exceeding $3 billion by 2021.

Transforming Supply Chains

Flexport’s platform allows businesses to manage their supply chains more effectively, providing transparency and real-time tracking. This innovation is crucial for e-commerce companies that rely on timely deliveries to meet customer expectations.

Recent Trends: The Rise of Sustainable E-commerce

In recent years, e-commerce venture capital firms have increasingly focused on sustainability as a key investment criterion. Companies like Allbirds, which produces eco-friendly footwear, have gained traction by appealing to environmentally conscious consumers.

Sustainable Investment Examples

Allbirds raised over $200 million from investors including Tiger Global Management and L Catterton, achieving a valuation of around $1.7 billion by 2021. Their commitment to sustainability resonates with consumers who prioritize ethical purchasing decisions.

Impact on Consumer Behavior

The rise of sustainable brands reflects a broader trend among consumers who are increasingly aware of their purchasing impact on the environment. E-commerce venture capital firms are responding by seeking out companies that align with these values, fostering innovation in sustainable practices across various industries.

E-commerce venture capital firms are at the forefront of transforming retail through strategic investments in innovative startups. Real-life examples like Warby Parker, Glossier, and Flexport illustrate how these firms not only provide financial backing but also contribute to shaping market trends and consumer behaviors. As e-commerce continues to evolve, the role of venture capital will remain critical in supporting new ideas that redefine how we shop and interact with brands. The focus on sustainability further underscores the potential for these investments to drive meaningful change in both business practices and consumer choices.

Getting Started in E-commerce Venture Capital: A Step-by-Step Guide

As I embark on the journey into the world of e-commerce venture capital, I recognize the importance of understanding both perspectives: that of an investor looking to fund innovative startups and that of an entrepreneur seeking investment. Here’s how I would approach this venture, followed by some advice for others considering a similar path.

Step 1: Research the E-commerce Landscape

My Approach:

I would begin by immersing myself in the e-commerce industry. This involves reading reports, articles, and case studies about successful e-commerce companies and understanding market trends. Websites like Statista and industry-specific publications provide valuable insights into consumer behavior, emerging technologies, and successful business models.

Advisory Insight:

Investors should conduct thorough research to identify key trends within e-commerce, such as shifts towards sustainability, the rise of direct-to-consumer brands, and advancements in logistics technology. Understanding these trends will help in making informed investment decisions.

Step 2: Build a Network

My Approach:

Networking is crucial in venture capital. I would attend industry conferences, webinars, and local meetups focused on ecommerce and venture capital. Connecting with other investors, entrepreneurs, and industry experts can provide insights and potential collaboration opportunities.

Advisory Insight:

Aspiring investors should actively engage in networking. Joining professional organizations or online communities can facilitate connections with seasoned investors and entrepreneurs. Building relationships can lead to valuable mentorship and partnership opportunities.

Step 3: Gain Relevant Experience

My Approach:

To enhance my credibility as an investor, I would seek opportunities to work with or within e-commerce startups. This could involve internships or advisory roles where I can learn about operational challenges and growth strategies firsthand.

Advisory Insight:

Experience in the e-commerce sector is invaluable. Investors should consider gaining hands-on experience by working with startups or established companies. This practical knowledge will help them better evaluate potential investments.

Step 4: Identify Investment Opportunities

My Approach:

Once I have a solid understanding of the market and relevant experience, I would start identifying promising startups that align with my investment thesis. This could involve utilizing platforms like AngelList or Crunchbase to discover emerging companies seeking funding.

Advisory Insight:

Investors should develop a clear investment thesis that outlines their criteria for selecting startups. This could include factors such as market size, team expertise, product differentiation, and scalability potential.

Step 5: Conduct Due Diligence

My Approach:

Before making any investment, I would perform thorough due diligence on potential startups. This includes analyzing financial statements, assessing market competition, and evaluating the founding team’s background and experience.

Advisory Insight:

Due diligence is critical in venture capital. Investors should meticulously assess a startup’s business model, financial health, and growth prospects to mitigate risks associated with their investments.

Step 6: Make the Investment

My Approach:

Once I am confident in a startup’s potential for success based on my research and due diligence, I would proceed to negotiate terms and finalize the investment agreement.

Advisory Insight:

Investors should be prepared to negotiate terms that protect their interests while also being attractive to entrepreneurs. Clear agreements regarding equity stakes, board representation, and exit strategies are essential components of the investment process.

Step 7: Support Portfolio Companies

My Approach:

After investing, I would actively support portfolio companies by providing strategic guidance, introductions to potential partners or customers, and assistance with scaling operations.

Advisory Insight:

Investors should take an active role in supporting their portfolio companies. Offering mentorship and resources can significantly enhance a startup’s chances of success while also increasing the value of the investor’s stake.

Step 8: Monitor Performance and Exit Strategy

My Approach:

I would regularly monitor the performance of my investments through updates from founders and financial reports. Understanding when to exit is crucial; whether through acquisition or IPO, having a clear exit strategy is essential for realizing returns.

Advisory Insight:

Investors should maintain an ongoing relationship with their portfolio companies while closely monitoring performance metrics. Developing a clear exit strategy will help maximize returns when the time comes to divest from an investment.

Entering the world of e-commerce venture capital requires dedication, research, networking, and strategic thinking. By following these steps—whether as an investor seeking opportunities or as an entrepreneur looking for funding—individuals can navigate this dynamic landscape effectively. The key lies in understanding both sides of the equation and being prepared to adapt as the e-commerce market continues to evolve.

Wrapping It Up

As I think about the world of e-commerce venture capital, it’s evident that this sector is growing and changing quickly. The firms I’ve looked into are actively supporting startups that are changing how we shop and engage with brands.

From major players like Andreessen Horowitz and Sequoia Capital to newer firms focused on sustainability and technology, there are many opportunities for both investors and entrepreneurs.

The success of companies like Warby Parker and Glossier shows the impact that strategic investment can have.

As I consider my own path—whether as an investor looking for promising opportunities or as an entrepreneur seeking funding—I see the importance of networking, thorough research, and having a clear investment strategy.

E-commerce venture capital offers significant potential, and I’m eager to explore how I can contribute to this dynamic field that drives innovation in retail.

FAQ

E-commerce venture capital refers to investments made by venture capital firms specifically in companies that operate within the online retail space or provide services that enhance e-commerce operations. These investments can support startups and established businesses in areas such as direct-to-consumer brands, marketplace platforms, logistics solutions, and technology providers.

E-commerce venture capital is crucial because it provides the necessary funding for innovative startups to develop their products, scale operations, and compete in a rapidly evolving market. With the growth of online shopping, venture capital firms play a key role in fostering innovation and supporting companies that can disrupt traditional retail models.

Recent trends include:

- Sustainability Focus: Investors are increasingly looking for companies that prioritize sustainable practices and products.

- Technological Innovation: Startups leveraging AI, machine learning, and blockchain technology are attracting significant interest.

- Global Expansion: Venture capital firms are exploring opportunities in emerging markets as e-commerce continues to grow worldwide.

To get started as an investor in e-commerce, you should:

- Research the Market: Understand current trends, consumer behavior, and successful business models.

- Build a Network: Attend industry events and connect with other investors and entrepreneurs.

- Gain Experience: Consider working with or within e-commerce startups to gain practical insight.

- Identify Opportunities: Use platforms like AngelList or Crunchbase to discover potential investment opportunities.

- Conduct Due Diligence: Thoroughly assess startups before making investments.

When evaluating an e-commerce startup, consider:

- Market Size and Growth Potential: Is there a large and expanding market for the product or service?

- Business Model Viability: Does the startup have a clear path to profitability?

- Founding Team Experience: Do the founders have relevant experience and a track record of success?

- Competitive Advantage: What differentiates this startup from its competitors?

- Customer Acquisition Strategy: How does the startup plan to attract and retain customers?

Yes, individuals can invest in e-commerce startups, particularly through platforms that facilitate equity crowdfunding or angel investing. However, it’s important to understand the risks involved, as many startups may not succeed.

Notable examples include:

- Warby Parker: An eyewear retailer that disrupted the market with a direct-to-consumer model.

- Glossier: A beauty brand that built a strong community around its products.

- Allbirds: A sustainable footwear company that has gained significant traction among eco-conscious consumers.

Challenges include:

- Market Saturation: With many players entering the market, distinguishing viable startups from those likely to fail is increasingly difficult.

- Rapidly Changing Consumer Preferences: Keeping up with shifts in consumer behavior can impact investment decisions.

- Regulatory Issues: Navigating complex regulations governing online commerce can pose challenges for both investors and startups.

E-commerce venture capital firms often provide more than just funding; they may offer strategic guidance, mentorship, introductions to potential partners or customers, and assistance with scaling operations. This support can significantly enhance a startup’s chances of success.

Investment sizes can vary widely depending on the stage of the company:

- Seed Stage Investments: Typically range from $100,000 to $2 million.

- Series A Investments: Often fall between $2 million and $10 million.

- Later Stage Investments (Series B and beyond): Can exceed $10 million, depending on the company’s growth trajectory and market potential.

To find funding as an e-commerce entrepreneur:

- Develop a Solid Business Plan: Clearly outline your business model, market analysis, and financial projections.

- Network with Investors: Attend pitch events or industry conferences where you can meet potential investors.

- Utilize Online Platforms: Consider equity crowdfunding platforms or angel investing networks to reach a broader audience of investors.

- Leverage Social Media and PR: Build your brand presence online to attract attention from investors interested in your niche.

Technology is central to e-commerce venture capital as it drives innovation within the sector. Investors are particularly interested in startups that leverage advanced technologies—such as artificial intelligence for personalized shopping experiences or blockchain for secure transactions—as these innovations can significantly enhance operational efficiency and customer engagement.

To stay informed about trends in e-commerce venture capital:

- Subscribe to industry newsletters and reports from sources like PitchBook or CB Insights.

- Follow relevant blogs and podcasts focused on entrepreneurship and venture capital.

- Join professional networks or associations related to venture capital or e-commerce.