Did you know that the right credit card can save Shopify store owners thousands of dollars each year in cashback, rewards, and business perks? If you’re spending money on ads, inventory, and shipping, choosing the right credit card can boost your cash flow, streamline expense tracking, and help your store scale faster.

As a Shopify entrepreneur, you’re constantly investing in your business—but are you earning rewards while doing it? With the right business credit card, you can separate personal and business expenses, optimize cashback on purchases, and unlock exclusive benefits that make running your Shopify store even more profitable.

In this guide, we’ll break down top business credit card options for Shopify store owners in 2025, compare rewards, and share expert tips on how to choose the perfect card to maximize your profits.

What’s the Best Credit Card for Shopify in 2025?

The best business credit card for your Shopify store depends on your spending habits:

- Best Overall: Shopify Credit Card – Up to 3% cashback, no annual fees.

- Best for Ads & Scaling: American Express Business Gold – 4X points on advertising and shipping.

- Best for High Spending: Capital One Spark Cash Plus – Unlimited 2% cashback, no preset limit.

- Best for Startups: Chase Ink Business Cash® – 5% cashback on office supplies, no annual fee.

Keep reading for a detailed breakdown of each card and how to choose the right one for your Shopify business!

Why Do Shopify Sellers Need a Business Credit Card?

Smart Shopify entrepreneurs leverage credit cards to gain financial flexibility and business rewards.

- Streamlined Cash Flow: Credit cards let you manage expenses while earning rewards, buying time for revenue to flow in.

- Separation of Finances: Dedicated business credit cards make accounting and tax preparation easier.

- Building Business Credit: Using credit responsibly strengthens your financial profile, unlocking better financing opportunities.

- Reward Maximization: From cashback on digital ads to travel perks for business trips, rewards cards turn expenses into assets.

Need more strategies to optimize your Shopify store’s finances?

The blog post “Best Free Shopify Marketing Apps” helps you!

What is the Best Credit Card for Shopify Store Owners in 2025?

Selecting the right credit card for your Shopify store can significantly impact your financial management, reward accumulation, and cash flow optimization.

The best card for your Shopify business depends on where you spend the most – whether it’s Facebook and Google Ads, bulk inventory purchases from suppliers, or shipping costs for fulfilling customer orders.

Which credit card is best for your store? That depends on your business needs. A cashback card will help reduce costs if you spend heavily on advertising. A travel rewards card might be ideal if you frequently travel for supplier meetings or networking events.

Below, we compare the 7 best business credit cards to help you choose the right one for your Shopify store.

Credit Card | Rewards | Annual Fees | Best For | Key Perks |

Shopify Credit | Up to 3% | Two convenient ways to pay | Subscription-Based Shopify Stores | No credit check, integrates with Shopify Payments |

Chase Ink Unlimited Credit | 5% cashback on office supplies | No Annual Fee | Small Shopify & Startups | $750 sign-up bonus |

Capital One Spark Cash Plus | Unlimited 2% cashback on all purchases | $150 | Luxury & High-Ticket Shopify Brands | No preset spending limit |

American Express Blue Card | 2% cashback on all purchases up to $50,000 per year | No Annual Fee | Shopify Stores with Frequent International Suppliers | Flexible spending power beyond your credit limit |

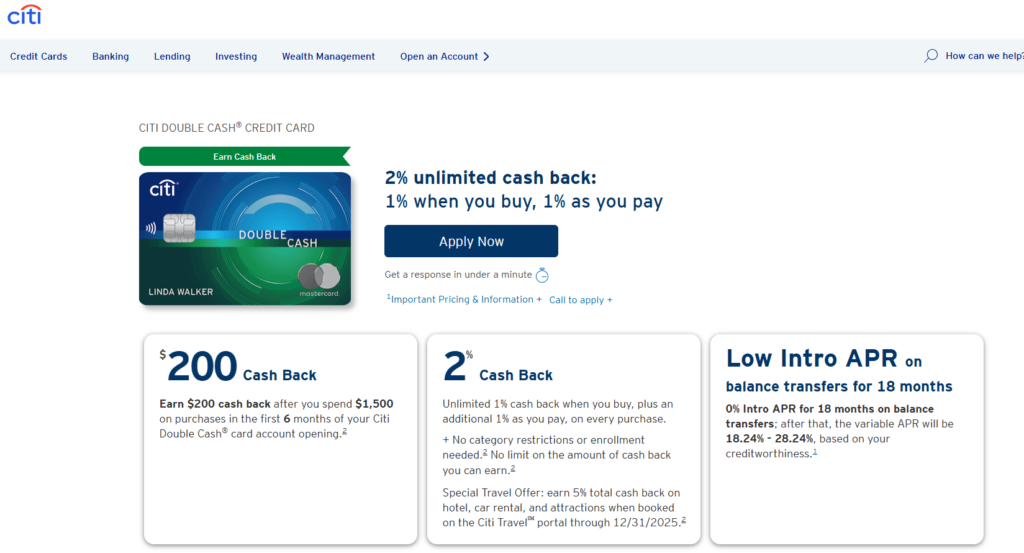

Citi Double Cash Card | Unlimited 2% (1% when you buy, 1% as you pay) | No Annual Fee | Print-on-Demand | Simple cashback structure, no category restrictions |

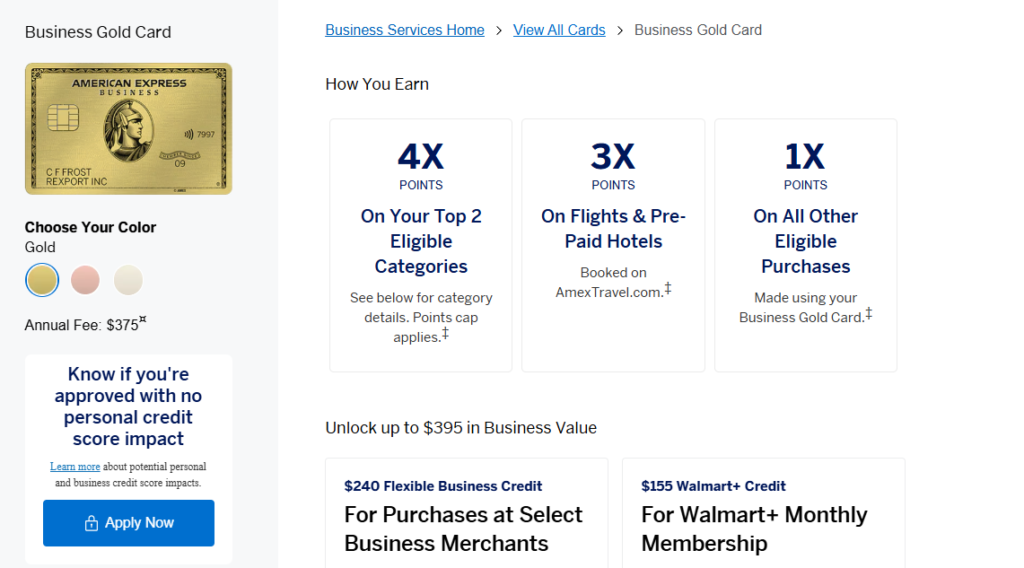

American Express Gold Card | 4x Membership Rewards Points | $295 | High-Volume Stores (Scaling Brands) | Best for Facebook or Google Ads & shipping |

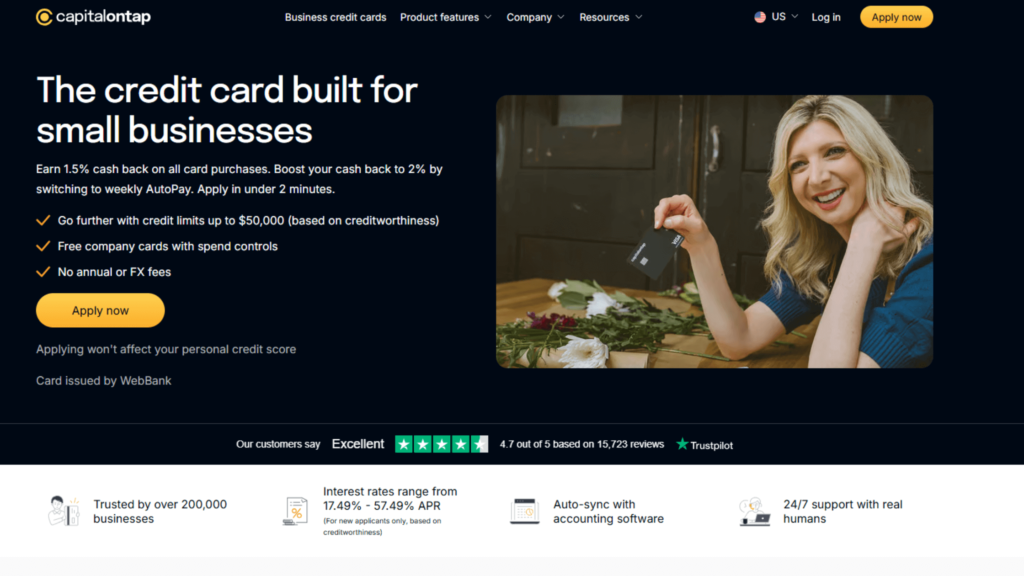

Capital On Tap Card | 2% cash back if customers choose weekly AutoPay in the US | No Annual Fee | Dropshipping Stores | High limits, fast approval |

Top 7 Credit Cards Recommended for Shopify Store Owners

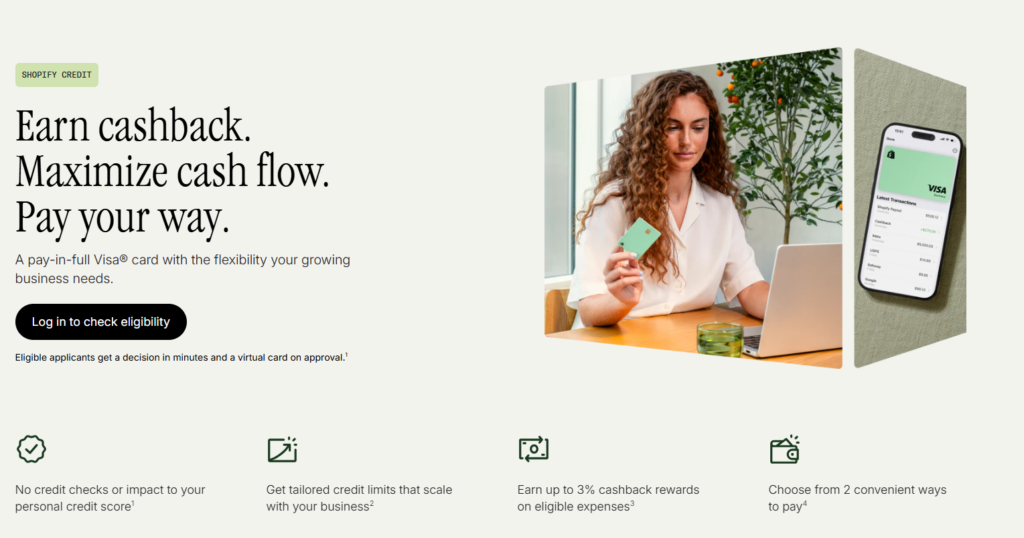

1. Shopify Credit

The Shopify credit card is a business card that requires you to pay your monthly statement in full within 10 calendar months after the statement period ends, and there is a fee for this. However, if you pay your entire balance within the first month of your statement period, you won’t incur any fees.

It is specifically designed and eligible Shopify store owners and offers features tailored to meet online businesses’ needs.

Rewards

You can earn up to 3% cashback on your top spend category, plus 1% on the rest of your eligible purchases.

Annual Fee

There are two convenient ways to pay:

- Pay monthly to skip fees

- Pay over time from sales for a fee

Key Features

-

No Personal Credit Checks: This makes it easier for Shopify store owners to qualify.

-

Scalable Credit Limits: Based on your Shopify store’s performance

-

Flexible Payments: Pay in full or over 10 months with fees.

-

No Extra Fees: No annual, foreign transaction, or card fees.

-

Instant Virtual Card: Use immediately after approval.

Shopify Business Model

Subscription-Based Shopify Stores

Why? Subscription-based businesses must manage recurring expenses while keeping cash flow steady. The Shopify Credit Card offers up to 3% cashback on top spending categories and integrates seamlessly with Shopify Payments, making it the best fit for merchants running a subscription-based store.

Opinion Piece: Is the Shopify Credit Card Worth It?

For Shopify store owners with steady revenue, this card is a great option. However, the exclusivity to Shopify merchants and the repayment terms may not suit all business models.

If you’re looking for broader rewards or travel perks, other options might fit better.

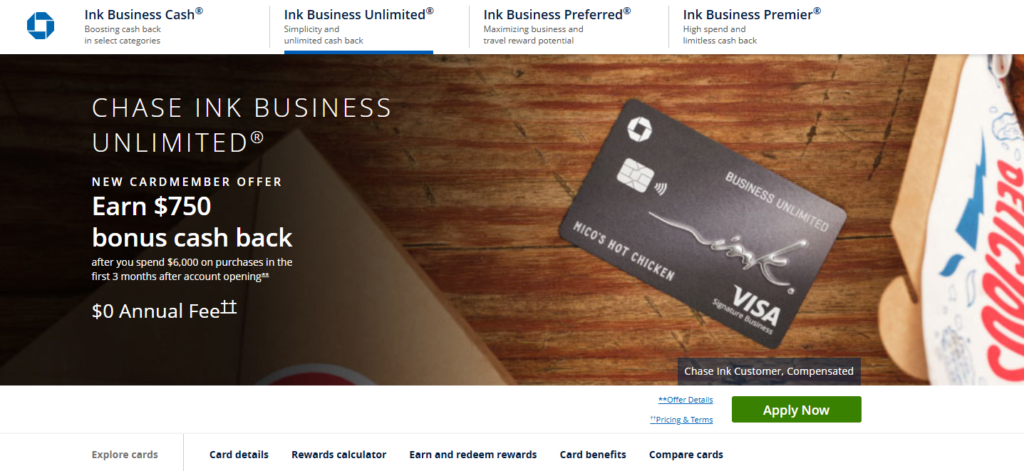

2. Chase Ink Business Cash℠ Credit Card

The Chase Ink Business Cash® Credit Card is designed to offer cash-back rewards tailored to small business spending.

It provides generous cash back on common business expenses like office supplies, internet, phone services, gas stations, and restaurants, with no annual fee.

Ideal for entrepreneurs with significant ad spend or office supply purchases.

Rewards

- 5% cashback on office supplies and telecom services (up to $25,000 annually).

- 2% cashback on gas stations and restaurants.

- 1% cashback on all other purchases.

Annual Fee

- There is no annual fee for this card.

Key Features

-

Sign-Up Bonus: Earn $750 cash back after spending $6,000 in the first 3 months.

-

Intro APR: 0% for 12 months on purchases, then 17.49%–29.99% variable APR

-

Perks: Free employee cards and expense management tools.

-

Cash Back: Up to 5% on select business categories, 1% on all other purchases.

-

Protection: Includes purchase protection and extended warranty coverage.

Shopify Business Model

Small Shopify Startups (New Sellers on a Budget)

Why? New Shopify sellers typically need low startup costs and high rewards. This card offers 5% cashback on office supplies, internet, and phone services—perfect for essential business expenses like Shopify subscription fees, email marketing tools, and website hosting.

Opinion Piece

A great fit for Shopify store owners who spend heavily on business infrastructure like ad campaigns and marketing tools.

3. Capital One Spark Cash for Business

The Capital One Spark Cash Plus is a business charge card designed to offer straightforward cash back rewards for small business owners.

A simple, high-cashback option for businesses with high monthly spending.

Rewards

- Unlimited 2% cashback on all purchases.

Annual Fee

- $150

Key Features

-

2% Cash Back on every purchase.

-

$1,000 Bonus for meeting spending requirements.

-

$150 Annual Fee with no foreign transaction fees.

-

Charge Card: The full balance must be paid monthly.

Shopify Business Model

Luxury & High Ticket Shopify Brands

Why? Selling high-ticket products (e.g., designer fashion, electronics, jewelry) requires big inventory purchases. This card provides unlimited 2% cashback on every purchase and no preset spending limit, making it ideal for merchants handling large transactions.

Opinion Piece

Perfect for Shopify entrepreneurs looking for straightforward, unlimited rewards. It’s a reliable choice for growing businesses with diverse expenses.

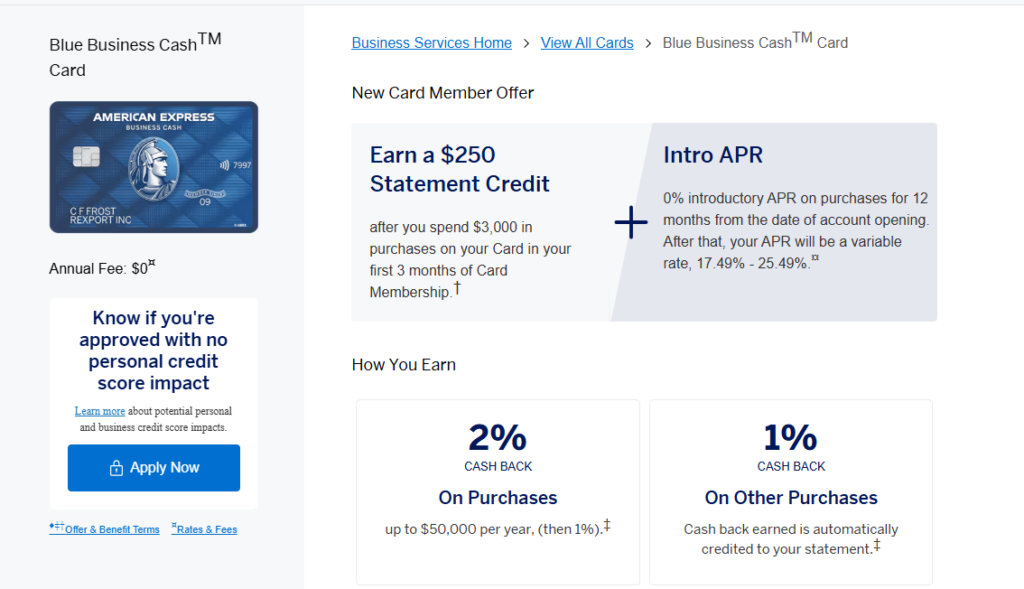

4. American Express Blue Business Cash™ Card

The American Express Blue Business Cash™ Card is a business credit card offering cashback rewards on eligible purchases. It provides 2% cashback on the first $50,000 spent each year (then 1%), and 1% on all other purchases.

Best for businesses with moderate annual expenses and predictable spending.

Rewards

- 2% cashback on all purchases up to $50,000 per year.

- 1% cashback after that.

Annual Fee

- No Annual Fee

Key Features

-

2% cashback on the first $50,000 spent annually (then 1%).

-

0% introductory APR for the first 12 months on purchases.

-

No annual fee, making it an affordable option for businesses.

-

Employee card option to earn cashback on all purchases made by employees.

-

Expense management tools to track and manage spending.

Shopify Business Model

Shopify Stores with Frequent International Suppliers

Why? Many Shopify store owners source inventory from international suppliers via Alibaba, AliExpress, or private manufacturers. This card offers no foreign transaction fees, 2% cashback on up to $50K in annual purchases, and 1% thereafter, making it perfect for handling bulk inventory orders without losing money on fees.

Opinion Piece

A top choice for Shopify store owners scaling up with manageable spending. Its no-fee structure is a big plus for cost-conscious entrepreneurs.

5. Citi Double Cash Credit Card

The Citi Double Cash Credit Card offers cashback on every purchase: 1% when you buy and an additional 1% when you pay for those purchases. It’s a straightforward rewards card with no annual fee and can be ideal for users who want consistent cashback on all their spending.

Earn as you spend and repay.

Rewards

- Unlimited 2% cashback (1% cashback when you buy, and an additional 1% when you pay it off)

Annual Fee

- No Annual Fee

Key Features

-

Flexible redemption: Cash rewards can be redeemed for statement credits, gift cards, or checks.

-

No categories or limits: Earn cashback on all purchases with no restrictions.

-

Introductory APR: A 0% APR for the first 18 months on balance transfers.

Shopify Business Model

Print-on-Demand (POD) Stores

Why? Since print-on-demand sellers don’t need to pre-purchase inventory, their biggest expenses come from ad spend and software tools (like Canva, Printify, or design freelancers). The 2% unlimited cashback (1% when you buy, 1% when you pay) makes this ideal for long-term profitability.

Opinion Piece

A no-fuss card for Shopify entrepreneurs who value consistent cashback on everyday expenses like shipping or inventory purchases.

6. American Express® Business Gold Card

The American Express Business Gold Card offers 4x points on the top two spending categories each month, such as advertising and shipping. It provides valuable business management tools, purchase protections, and travel benefits, making it a strong choice for small businesses.

Great for store owners looking to optimize cashback in specific spending categories.

Rewards

- 4X Membership Rewards® points on two categories where you spend the most (advertising, shipping, and more).

Annual Fee

- $295

Key Features

-

Customization: Adjusts rewards categories to your spending patterns.

-

Purchase Protection: Includes extended warranty and purchase protection benefits.

-

Business Management Tools: Access to tools for managing expenses and tracking rewards.

-

4x Points: Earn 4x points on the top two spending categories each month.

Shopify Business Model

High-Volume Stores (Scaling Brands)

Why? Shopify sellers scaling to $100K+ per month often spend heavily on ads and shipping. The 4X Membership Rewards points on top spending categories (e.g., advertising, shipping) make this perfect for reinvesting profits and accelerating growth.

Opinion Piece

With its flexible reward system, this card is best for Shopify merchants focusing on targeted spending like digital ads and shipping.

If your Shopify store is spending thousands on Facebook and Google Ads, you need a business credit card that rewards your marketing expenses.

Check out our guide on The Best Shopify Ad Strategies to Scale to 7 Figures for expert insights on increasing your return on ad spend.

7. Capital on Tap Business Credit Card

The Capital on Tap Business Credit Card is designed for e-commerce owners looking for flexible spending limits, easy approvals, and cashback rewards.

Rewards

- 1.5% cash back, boosted to 2% with weekly AutoPay (in the US!)

Annual Fee

- No Annual Fee

Key Features

-

No Annual Fee – A cost-effective choice for Shopify store owners

-

Unlimited 1.5% Cashback – On all card purchases.

-

Fast and Easy Approvals – Get a decision within minutes.

-

Credit Limits Up to $50,000 – Supports high-volume e-commerce businesses

-

Instant Virtual Cards – Use your card immediately after approval.

Shopify Business Model

Dropshipping Stores

Why? Dropshippers often deal with inconsistent cash flow and variable expenses when ordering inventory from suppliers. A high credit limit, no annual fee, and unlimited 1.5% cashback on all purchases make this an excellent choice for maintaining liquidity.

Opinion Piece

The Capital on Tap Business Credit Card is perfect for Shopify store owners who need higher credit limits to scale ad campaigns, purchase inventory in bulk, and cover operational expenses – all while earning unlimited cashback.

It is worth mentioning that they offer 2% cash back if customers choose weekly AutoPay in the US!

Dropshippers often face inconsistent cash flow and fluctuating expenses. A high credit limit with no annual fee helps maintain stability.

New to dropshipping? Check out our detailed guide on How to Start a Profitable Shopify Dropshipping Store.

With so many great credit card options, how do you choose the right one?

The best card for your Shopify store depends on your business size, spending habits, and financial goals. Below are key factors to consider when making your decision.

Which Shopify Business Credit Card Should You Choose?

When selecting a credit card, consider these factors:

- Spending Habits: Do you spend more on ads, inventory, or travel? Choose a card that aligns with your top expense categories.

- Rewards vs. Fees: Evaluate whether the rewards outweigh any annual or foreign transaction fees.

- Flexibility: Opt for cards that offer scalable credit limits based on business performance.

- Additional Perks: Consider perks like purchase protection, employee cards, or travel benefits.

How to Maximize Shopify Credit Card Rewards & Cashback?

To make the most of your chosen credit card:

- Leverage Bonus Categories: Use cards offering high cashback rates for ads, shipping, or office supplies.

- Pay Balances in Full: Avoid interest charges to optimize the value of your rewards.

- Track Rewards: Monitor reward earnings and expiration dates to ensure you’re fully utilizing benefits.

- Combine Cards: Use multiple cards strategically to cover different spending categories and optimize overall rewards.

Balancing reward maximization with financial responsibility is essential for long-term health as a Shopify store owner.

How to Use Credit Cards to Scale Your Shopify Store Faster?

Many business credit cards offer 0% intro APR for 12+ months. Use this to stock up on inventory before peak seasons without cash flow stress.

If you spend $10,000 per month on Facebook/Google Ads, a 2% cashback card earns you $200 per month ($2,400 per year) in free ad spend.

Some cards offer purchase protection, which can refund money if items like cameras, computers, or Shopify POS systems get damaged.

Why Credit Cards Are a Smart Move for Shopify Store Owners?

By using credit cards strategically, Shopify entrepreneurs can:

- Manage cash flow more effectively.

- Build a strong credit profile for future business financing.

- Earn rewards that can be reinvested into growth.

Common Mistakes Shopify Owners Make with Business Credit Cards

- Not Paying Balances in Full – Many Shopify owners only make minimum payments, leading to high-interest charges that eat into profits. Always pay in full!

- Choosing the Wrong Card for Their Business Needs – If you spend $5,000/month on ads, but your card only gives 1% cashback, you’re leaving money on the table.

- Mixing Personal and Business Expenses – Keep Shopify-related purchases separate for better tax deductions and bookkeeping.

Final Thoughts: Choose the Right Credit Card & Scale Your Shopify Store

The right credit card isn’t just a payment tool—it’s a powerful asset that can reduce expenses, maximize cashback, and improve cash flow for your Shopify business.

Whether you’re looking for higher credit limits, ad spend rewards or travel perks, there’s a perfect card to match your business needs. Now is the time to start optimizing your Shopify store finances! Compare your options and choose the best credit card today.

Apply now and start earning cashback on your Shopify expenses!

Have questions? Reach out to Dario personalized recommendations.

FAQs – Best Credit Card to Use with Shopify Store

Do I need a Business Credit Card to start My Shopify Store?

No, you don’t need a credit card to start Shopify. Shopify offers a 3-day free trial, and you can explore its features without entering any payment details.

Once the trial ends, you’ll need a payment method like a credit card or PayPal to choose a subscription plan.

What Business Credit Cards are accepted on Shopify?

Shopify supports most major credit and debit cards, including Visa, Mastercard, American Express, and Discover.

Additionally, alternative payment methods like PayPal, Apple Pay, and Google Pay are also available depending on the payment gateway you use.

Is Shopify safe for Credit Card transactions?

Yes, Shopify is highly secure for credit card transactions. It uses SSL encryption and is PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that your sensitive data is protected.

What is the Best Payment Method for Shopify in 2025?

The best payment method for Shopify depends on your business model, whether you prefer Shopify Payments, PayPal, or third-party gateways.

Want a full breakdown? Read our in-depth guide on How to Set Up Strong Shopify Payment Gateways in 2025.

How does the Shopify Credit Card work?

You can use your card to make purchases wherever Visa or Mastercard are accepted.

Simply swipe or insert your card and choose “Credit” (even though it’s a debit card).

Depending on the transaction amount, either enter your PIN or sign the receipt.

The funds will be taken directly from your linked Shopify Balance account.