Automating Financial Processes: How Useful Is That?

“Automating financial processes can save you money. It can even keep you out of trouble with the IRS. Spend money to save money. Etc.”

Big promises. AI is all about that: big promises. But how much of that it can deliver?

Over the past nearly a decade, I’ve automated all kinds of processes and workflows within dozens of my, and my clients’ companies, including automating my money flows. If there’s an expert on business and financial automation, that would be me.

So, in this blog, I’ll summarize my knowledge in an easily digestible way so you can read it in less than 11 minutes and reap some benefits from it. The best thing is that all this will be free. If you want to give something back, you can click on this link here, or this one, or this one, and learn more about this topic.

After that, go make money, invest it, grow businesses, get rich, start new companies, revolutionize industries.

What I Discussed in This Blog Post

Key Benefits and Personal Experience: Automating financial processes improves efficiency, accuracy, and cost savings. My personal experience highlighted the immediate benefits of transitioning to automated systems.

Detailed Statistics: Statistics show a significant shift towards automation in finance, with predictions that 80% of accounting tasks will be automated by 2024. Businesses report increased efficiency and positive impacts on job opportunities.

Future Trends: The future of financial automation includes advancements in AI, machine learning, and blockchain technology, promising further improvements in efficiency, security, and transparency.

Key Benefits of Automating Financial Processes

When it comes to automating financial processes, the benefits are numerous and impactful. Here are some key advantages:

- Efficiency: Automation speeds up financial tasks, allowing employees to focus on more strategic activities.

- Accuracy: Automated systems reduce the risk of human error, ensuring more accurate financial data.

- Cost Savings: By reducing the need for manual labor, companies can save on operational costs.

- Compliance: Automated processes help ensure compliance with financial regulations by maintaining accurate records and generating timely reports.

- Scalability: As businesses grow, automated systems can easily scale to handle increased financial transactions.

My Personal Experience with Automating Financial Processes

In my own experience, automating financial processes has been transformative. I used to spend hours manually reconciling accounts and generating financial reports. Implementing automation tools not only saved me time but also improved the accuracy of my work. The transition was smooth, and the benefits were immediate.

I could focus on more strategic tasks, knowing that the automated systems were handling the routine financial operations efficiently. This shift allowed me to contribute more meaningfully to the company’s growth and success.

Detailed Statistics on Automating Financial Processes

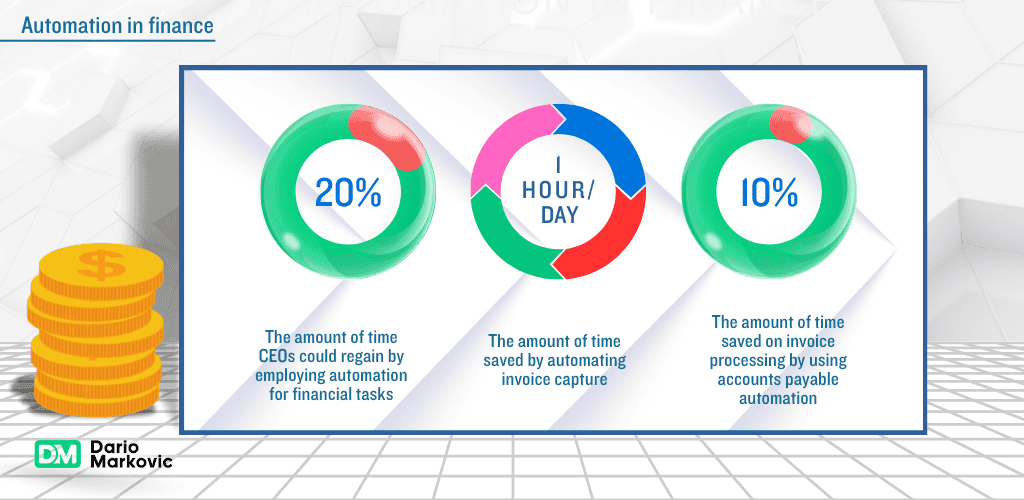

Automating financial processes has become a significant trend in the business world, driven by the need for efficiency, accuracy, and cost savings. The adoption of automation in finance is supported by a wealth of statistics that highlight its benefits and growing prevalence. Here, we delve into the detailed statistics surrounding this topic.

The adoption of automation in financial processes is on the rise, with many businesses recognizing its potential to transform their operations. According to a report by McKinsey, over 60% of finance activities can be automated with current technology.

This includes tasks such as data entry, reconciliation, and reporting, which are traditionally time-consuming and prone to errors.

Key Statistics on Finance Automation

- 80% of accounting tasks are predicted to be automated by 2024.

- 89% of businesses using automation report increased efficiency in their finance teams.

- 78% of businesses feel positive about the impact of automation on job opportunities in the finance sector.

- 31% of businesses have fully automated at least one function.

- 26% of an organization’s automations fall under finance, making it the most automated business function.

- 57% of finance automations are related to the order-to-cash process.

- 39% of finance professionals are actively building their department’s automation.

- 335% increase in automating returns and refunds year-over-year.

These statistics underscore the significant shift towards automation in the financial sector and its positive impact on efficiency and job satisfaction.

The financial services industry is also heavily investing in AI and automation technologies. In 2023, the industry invested an estimated $35 billion in AI, with banking leading the charge, accounting for approximately $21 billion.

This investment is a clear indication of the industry’s commitment to leveraging advanced technologies to improve financial processes.

Benefits Highlighted by Statistics

The benefits of automating financial processes are well-documented through various studies and reports. For instance, Siemens reported that automating their financial processes, such as accounts payable and receivable, reduced errors in financial reporting by 80% and saved the company $5 million per year.

This example illustrates the tangible benefits that businesses can achieve through automation.

Moreover, a survey by Tally Solutions found that 89% of businesses using automation in financial processes experienced increased efficiency in their finance teams.

This efficiency gain allows finance professionals to focus on more strategic tasks, such as financial planning and analysis, rather than mundane data entry and reconciliation tasks.

Future Trends and Projections

Looking ahead, the future of automating financial processes appears promising. The integration of AI and machine learning (ML) is expected to further enhance the capabilities of automation tools. AI and ML can handle more complex financial tasks, such as predictive analytics and fraud detection, which were previously beyond the scope of traditional automation tools.

Additionally, blockchain technology is poised to revolutionize financial transactions by providing enhanced security and transparency. As businesses continue to adopt these advanced technologies, the scope and impact of automating financial processes will only grow.

In summary, the statistics surrounding automating financial processes paint a clear picture of its benefits and growing adoption. From increased efficiency and accuracy to significant cost savings, automation is transforming the financial sector. As technology continues to evolve, the potential for further advancements in this area is immense.

Common Financial Processes to Automate

There are several financial processes that can be automated to improve efficiency and accuracy.

Accounts payable is one such process, where automation can streamline invoice processing and payments. Similarly, accounts receivable can benefit from automation by simplifying the billing and collections process.

Expense management is another area where automation can make a significant difference, automating expense reporting and reimbursement. Payroll processes can also be automated, handling everything from calculating wages to disbursements.

Lastly, financial reporting can be automated to generate accurate and timely reports, providing valuable insights for decision-making.

Challenges in Automating Financial Processes

While automating financial processes offers many benefits, it also comes with challenges. Initial costs can be a barrier, as implementing automation tools can be expensive.

Integration is another challenge, as new systems need to seamlessly integrate with existing software. Training employees to use new automated systems effectively is crucial, but it can be time-consuming and require significant effort.

Data security is a major concern, as protecting sensitive financial data from cyber threats is paramount.

Lastly, managing the transition from manual to automated processes can be challenging, requiring careful planning and change management.

Best Practices for Automating Financial Processes

To successfully automate financial processes, it’s important to follow best practices. Start by assessing your needs and identifying which financial processes will benefit most from automation.

Choose the right tools that fit your business needs and budget.

Develop a detailed implementation plan, including timelines and milestones, to ensure a smooth transition. Provide comprehensive training to ensure employees are comfortable with the new systems.

Continuously monitor the automated processes and make adjustments as needed to optimize performance.

Future Trends in Automating Financial Processes

The future of automating financial processes looks promising, with several trends emerging. Artificial Intelligence (AI) will – hopefully- play a significant role in automating complex financial tasks. If Google, OpenAI, and Anthropic stop lying that they have AIs that they don’t have. Yet?

Machine Learning (ML) algorithms will improve the accuracy and efficiency of automated financial processes. Blockchain technology will enhance the security and transparency of financial transactions. Robotic Process Automation (RPA) will continue to streamline repetitive financial tasks.

Cloud-based solutions will offer greater flexibility and scalability, making automation accessible to businesses of all sizes.

This is all, of course, if we keep the pink glasses and a positive outlook. I always try to do that, within reason.

Automating financial processes is not just a trend but a necessity for businesses aiming to stay competitive. By automating our work, we can be more efficient, accurate, precise, and punctual.

Real-Life Experiences with Automating Financial Processes

In exploring the real-world impact of automating financial processes, I turned to Reddit to find firsthand accounts from users who have implemented these systems.

Here are three experiences shared by individuals from different sectors, highlighting the practical benefits and challenges they encountered.

1. Experience

One user shared their experience with automating accounts payable at a mid-sized company. They implemented a system that automatically processed invoices and matched them with purchase orders. This automation reduced the time spent on manual data entry and significantly decreased errors.

The user noted that the system also provided real-time visibility into outstanding invoices, which improved cash flow management. They emphasized the importance of thorough testing before full implementation to ensure the system worked seamlessly with their existing ERP software.

2. Experience

Another user discussed their journey with automating expense management in a large corporation. They introduced an automated expense reporting tool that allowed employees to submit expenses via a mobile app. The tool automatically categorized expenses and flagged any discrepancies for review.

This automation not only sped up the reimbursement process but also improved compliance with company policies. The user highlighted the positive feedback from employees, who appreciated the convenience and efficiency of the new system.

3. Experience

A third user shared their story of automating payroll processes in a small business. They implemented a cloud-based payroll system that handled everything from calculating wages to filing taxes. The user reported that the automation saved them several hours each week and reduced the risk of payroll errors. They also mentioned that the system’s integration with their accounting software made financial reporting much easier. The user advised others to choose a system that offers robust customer support, as this was crucial during the initial setup phase.

These real-life examples illustrate the tangible benefits of automating financial processes, from increased efficiency and accuracy to improved compliance and employee satisfaction. While the implementation process can present challenges, the long-term advantages make it a worthwhile investment for businesses of all sizes.

FAQ

- Automating financial processes improves efficiency, accuracy, and cost savings. It also helps ensure compliance with financial regulations and provides real-time financial insights.

- Common processes include accounts payable, accounts receivable, expense management, payroll, and financial reporting.

- Automation reduces the risk of human error by standardizing processes and ensuring consistent data entry and calculations.

- Initial costs can vary depending on the complexity of the system and the size of the business. Costs typically include software licenses, implementation fees, and training expenses.

- The implementation timeline can range from a few weeks to several months, depending on the scope of the project and the readiness of the organization.