Simplifying Your Financial Life

Managing finances can be daunting, especially when juggling invoices, expenses, payroll, and tax compliance. Learn how does QuickBooks work, and you’ll have a helpful organizer, tracker, and analyzer for your business transactions. It can be a valuable helper to any business owner.

In this guide, we’ll explore how QuickBooks works and provide practical tips for success. Whether you’re a small business owner, a freelancer, or part of a larger organization, understanding QuickBooks can significantly streamline your financial processes and empower better decision-making.

What Is QuickBooks?

QuickBooks is an accounting software developed by Intuit. Many accounting professionals recommend it. It’s designed to handle various financial tasks, including:

Bookkeeping: Recording income and expenses, managing accounts payable and receivable, and reconciling bank statements.

Invoicing: Creating professional invoices for your products or services.

Payroll: Managing employee salaries, tax withholdings, and benefits.

Financial Reporting: Generating balance sheets, profit and loss statements, and other essential reports.

Tax Compliance: Simplifying tax preparation by organizing data for your accountant.

Reasons You Need to Know How Does QuickBooks Work

Understanding how QuickBooks works is essential for anyone looking to streamline their financial management. Here’s why:

Save Time: Automate routine tasks like invoicing and expense tracking.

Accuracy: Reduce errors with precise record-keeping.

Financial Insights: Gain valuable insights into your business’s financial health.

Compliance: Ensure your financial records are compliant with tax regulations.

Professionalism: Present professional-looking invoices and reports.

Knowing how QuickBooks works can be a game-changer for any business and business owner. It’s not just about saving time and reducing stress; it’s about taking control of your finances and making informed decisions.

You can use this bookkeeping software to track your bank and credit card money flow, keep an eye on your business growth, pay enabled invoices, create financial statements, store all your data related to your business finances, and much more.

Step-by-Step Instructions to Master QuickBooks

1. Setting Up Your Company Profile

Before diving in, create your company profile within QuickBooks—input essential details like your business name, address, and fiscal year. You can connect your bank and bank account, too.

QuickBooks online account will be your primary financial control hub from that point on.

2. Connecting Your Bank Accounts

Link your business bank accounts to QuickBooks. This allows automatic transaction syncing, making reconciliation a breeze.

3. Creating Invoices and Managing Receivables

- Generate professional invoices for your clients.

- Track outstanding payments and send reminders.

- Record customer payments against invoices.

4. Recording Expenses and Managing Payables

- Enter expenses (e.g., office supplies, rent, utilities).

- Set up recurring bills for regular payments.

- Reconcile vendor payments with bank transactions.

5. Running Financial Reports

- Explore balance sheets, income statements, and cash flow reports.

- Understand your business’s financial health.

- Identify areas for improvement.

Key Considerations for Successful QuickBooks Use

Consistency: Regularly update your records to maintain accuracy.

Backups: Back up your QuickBooks data to prevent loss.

Training: Invest time in learning the software—attend webinars or take courses.

Taking It to the Next Level: Advanced QuickBooks Tips

Customization: Tailor QuickBooks to your specific needs by customizing fields and reports.

Integrations: Explore third-party apps that sync seamlessly with QuickBooks (e.g., inventory management, time tracking).

Advanced Reporting: Dig deeper into financial insights using custom reports.

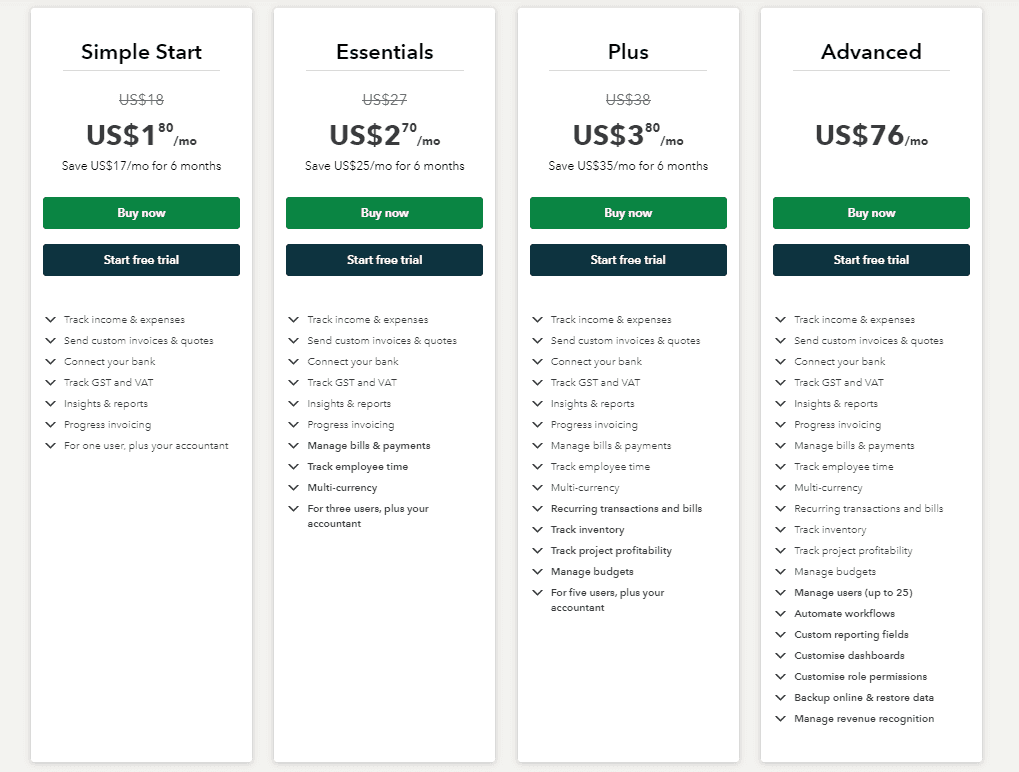

QuickBooks Pricing

QuickBooks Online offers several subscription levels, each tailored to different business needs.

QuickBooks Online also offers a free 30-day trial for all plans, allowing you to explore the features before committing.

If you’re not ready for full accounting yet, consider QuickBooks Money—a solution that provides banking, payments, and a 5.00% APY without any subscription or starting fees.

Alternatives to QuickBooks

While QuickBooks is fantastic, consider these alternatives:

Some QuickBooks Stats

1. Market Share Dominance

- QuickBooks reigns supreme, commanding an impressive 81% share of the accounting software market. In comparison, Sage 50 and Xero trail behind with market shares of 10% and 9%, respectively.

2. Business Adoption

- Approximately 29 million businesses in the United States rely on QuickBooks for their financial management. That’s a substantial chunk of the business landscape.

- Globally, QuickBooks Online boasts 5.3 million users. It’s like a worldwide financial symphony, with QuickBooks as the conductor.

3. Geographical Distribution

- 80% of QuickBooks customers call the United States home. Yep, it’s practically the official accounting software of the Stars and Stripes.

- Meanwhile, our friendly neighbors to the north, Canada, make up 5% of the QuickBooks user base.

4. QuickBooks Online Subscribers

- As of 2023, QuickBooks Online has 6.5 million subscribers. That’s roughly 65% of its 10 million-strong customer base.

5. Intuit’s Revenue Impact

-

-

- Intuit’s Small Business & Self-Employed segment—the home of QuickBooks—accounts for a whopping 56% of Intuit’s total revenues. It’s the financial engine driving the company.

- QuickBooks Online outshines its desktop counterpart, generating 2.1 times more revenue. No wonder they’re phasing out QuickBooks Desktop for new users starting August 1, 2024.

-

Wrapping Up and My Experience With QuickBooks

Starting accounting journal entries for new entities with separate balance sheets was a breeze. QuickBooks (QB) offered a rich array of ready-to-use functionalities, which I appreciated. Plus, its connectivity to most banking APIs and factoring accounts in North America made financial management smoother. And let’s talk pricing—it fit snugly for companies of all sizes and use cases.

However, customization of accounting ledgers proved tricky. On the bright side, having an audit log with time and location tracking helped supervise contractors effectively. But here’s my wish: pre-configured GAAP/IFRS forms for audit and securities reporting would be a game-changer. Unfortunately, stable connectivity to resource tracking tools (like inventory or fleet management systems) remained elusive—sync errors haunted us.

Now, let’s get personal. We relied on QuickBooks for accounting in our North American subsidiary. Why? Well, it seamlessly connected to local banks, invoice management systems, and our payroll setup. Plus, it stayed up-to-date with local tax rules—a real productivity booster. But here’s the caveat: if you’re in the service industry, QuickBooks is your go-to. Just remember to double-check inventory balances and turnovers—the sync isn’t always lightning-fast.

In summary, QuickBooks has been our trusty companion, navigating the financial landscape with us. It’s not flawless, but it gets the job done.

FAQ

QuickBooks is an accounting software developed by Intuit. It helps businesses manage their financial transactions, track income and expenses, create invoices, handle payroll, and generate essential reports.

Yes. QuickBooks Online is cloud-based, accessible from any device with an internet connection. QuickBooks Desktop is installed on your computer and offers more robust features but lacks the flexibility of cloud access.

First, choose between QuickBooks Online or QuickBooks Desktop. Then, set up your company profile, connect bank accounts, and start recording transactions.

Absolutely! QuickBooks simplifies payroll tasks, including calculating employee salaries, tax withholdings, and generating paychecks.

QuickBooks helps with tax compliance. You can track sales tax, prepare tax forms, and even e-file directly from the software.

Use QuickBooks to match your recorded transactions with bank statements. It ensures accuracy and catches any discrepancies.

QuickBooks offers various reports: profit and loss, balance sheet, cash flow, and more. These insights help you make informed decisions.

Yes! QuickBooks integrates with many third-party apps, such as inventory management tools, CRM systems, and e-commerce platforms.

Intuit provides customer support via phone, chat, and community forums. You can also find answers in the QuickBooks Community.

Pricing varies based on the version (Online or Desktop) and the features you need. Check the official QuickBooks website for current pricing details.