TOP PERSONAL PICKS

Although owning a business is thrilling, it comes with risks. One important thing is finding the best liability insurance providers among the top business insurance companies to suit your different needs.

It isn’t about any insurance—this will be the safety net to let you focus on tending to your dream. Here, you will be at peace and confident taking calculated risks, such as expanding your customer base or adding new product lines.

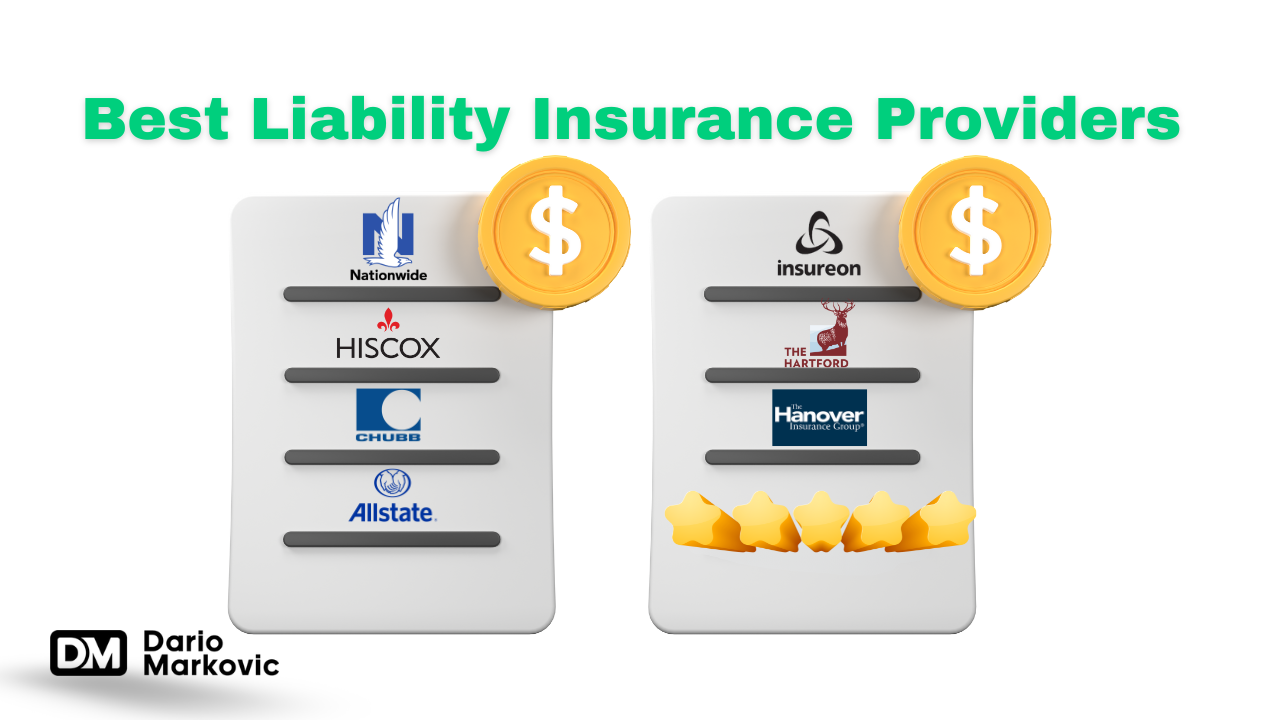

Who Are the Best Liability Insurance Providers?

When small business owners run a business, one of the most critical decisions they will ever make is choosing a liability insurance provider. It is the first defense line against legal surprises that could debilitate any business financially. With the huge number of providers who offer changing scopes of coverage, specialized policies, and fringe benefits, choosing the right insurer can be an uphill task.

What stands out in 2024 is that companies offer reliability, customer service, and tailoring solutions to the different business needs operating in various industries. Below is an overview that will give you a proper understanding of the top professional liability insurance providers so you can make informed decisions.

1. Nationwide

Overview: Nationwide is a well-established insurer known for offering various insurance products, including liability insurance. The company provides coverage tailored to specific industries, such as food service, retail, and construction. This specialization makes Nationwide a strong choice for businesses with unique risks.

Strengths:

-

- Customized Business Owner’s Policies (BOPs): Nationwide’s BOPs are highly customizable, allowing businesses to add endorsements like product liability, liquor liability, and hired and non-owned auto coverage. These endorsements are particularly beneficial for industries like food service.

-

- Comprehensive General Liability Insurance Coverage: Nationwide offers comprehensive general liability insurance coverage, protecting businesses from financial losses related to third-party claims of bodily injury, property damage, and advertising injury.

-

- Financial Strength: With an A rating from AM Best, Nationwide is financially stable, ensuring they can handle large claims.

Weaknesses:

-

- Customer Service: Nationwide requires customers to speak with an agent to get quotes or change their policies, which may be less convenient for some businesses.

-

- Complaints: According to the NAIC, the company has received more customer complaints than expected, which could indicate issues with customer satisfaction.

2. Hiscox

Overview: Hiscox specializes in providing liability insurance for small businesses and startups. It is known for its tailored policies and its ability to quickly obtain coverage online. Hiscox also specializes in small business insurance, offering various coverage options tailored to the unique needs of small business owners.

Strengths:

-

- Tailored Coverage: Hiscox offers specialized policies for various industries, including professional services, IT, and consulting, making it a strong choice for niche businesses.

-

- Ease of Access: Hiscox’s online platform is user-friendly, allowing businesses to get a quote and purchase a policy quickly. They also offer instant certificates of insurance, which can be crucial for businesses needing proof of coverage on short notice.

-

- Global Reach: Hiscox operates internationally, providing coverage to businesses in multiple countries, which is advantageous for companies with global operations.

Weaknesses:

-

- Premiums: Hiscox can be more expensive than other providers, particularly for businesses with higher risk profiles.

-

- Limited Coverage Options: While Hiscox excels in specific areas, their general liability insurance policy might not be as comprehensive as that of other providers for larger businesses.

3. Chubb

Overview: Chubb is one of the largest insurance companies globally, offering various liability insurance options. It is known for its superior claims handling and extensive risk management services.

Strengths:

-

- Comprehensive Coverage: Chubb offers extensive liability coverage, including general liability insurance, product liability, and professional liability. Their customizable policies allow businesses to build a package that meets their needs.

-

- Risk Management Services: Chubb provides businesses access to risk engineering services that help mitigate risks and potentially reduce premiums.

-

- Claims Handling: Chubb is renowned for its excellent claims handling process, ensuring that claims are processed quickly and fairly.

Weaknesses:

-

- Cost: Chubb’s policies are more expensive, which may not be ideal for small businesses with limited budgets. The general liability insurance cost can vary, with average costs around $42 per month or $1,057 per year, emphasizing the need for personalized quotes to determine specific premiums.

-

- Complexity: Given the breadth of options and customizations, navigating Chubb’s offerings can be complex, requiring businesses to work closely with an agent to ensure they get the right coverage.

4. AllState

Overview: Allstate is a well-known name in the insurance industry. It offers a variety of personal and business insurance products, including liability coverage. Allstate is particularly recognized for its strong customer service.

Strengths:

-

- Customer Service: Allstate has a strong reputation for customer service, with numerous local agents available to assist businesses in finding the right coverage.

-

- Comprehensive Offerings: Allstate offers a range of liability insurance options, including general liability, professional liability, business auto insurance, and commercial auto insurance. This makes it a versatile choice for many businesses.

Weaknesses:

-

- Pricing: Allstate’s liability insurance can be pricier than other providers, especially for small businesses.

-

- Limited Online Capabilities: While Allstate has improved its digital presence, obtaining quotes and managing policies may require more agent interaction than modern providers like Hiscox or Next Insurance.

5. Insureon

Overview: Insureon operates as an online insurance marketplace, helping businesses compare quotes from multiple insurers. This platform is ideal for small businesses looking for competitive pricing and various options.

Strengths:

-

- Variety of Options: Insureon allows businesses to compare liability insurance quotes from top-rated insurers, ensuring they find the most competitive rates and suitable coverage.

-

- Ease of Use: The online platform is straightforward, with an intuitive interface allowing businesses to obtain and compare quotes quickly.

-

- Customizable Policies: Insureon offers a wide range of coverage options, including business interruption insurance, allowing businesses to tailor their policies to their needs.

Weaknesses:

-

- Customer Service Variability: Since Insureon is a marketplace, the quality of customer service can vary depending on the insurer chosen.

-

- Limited Direct Support: Unlike dealing directly with an insurer, using a marketplace might result in less direct support during the claims process.

6. The Hartford

Overview: Hartford is a well-established insurance company known for its strong focus on small businesses. It offers various liability insurance options, including workers’ compensation insurance, which covers medical costs and lost wages for injured employees. This insurance is different from general liability insurance. The Hartford is highly regarded for its customer service and claims handling.

Strengths:

-

- Small Business Focus: The Hartford tailors its policies specifically for small businesses, offering customized BOPs that include liability coverage, commercial property insurance, and more.

-

- Financial Strength and Stability: The Hartford has strong financial ratings, ensuring it can cover large claims and remain a reliable business partner.

-

- Claims Excellence: The Hartford is known for its efficient claims process, crucial for businesses needing quick resolution during crises.

Weaknesses:

-

- Cost: Similar to Chubb, The Hartford’s policies can be more expensive, especially for businesses that don’t qualify for discounts or have higher risk profiles.

-

- Limited Coverage Options: While The Hartford excels with small businesses, larger enterprises may find their coverage options limited compared to more expansive providers like Chubb.

7. The Hanover

Overview: The Hanover offers various insurance products, including tailored business liability insurance. It is known for its customizable policies and strong customer support.

Strengths:

-

- Customizable Policies: The Hanover allows businesses to build customized insurance packages that include various liability coverage forms, ensuring they are adequately protected. This includes professional liability coverage, which protects professionals from lawsuits related to the quality of their services.

-

- Industry Expertise: The Hanover has specialized knowledge in several industries, including construction, healthcare, and retail, making them a strong choice for businesses in these sectors.

Weaknesses:

-

- Pricing Transparency: The Hanover’s pricing can be less transparent, often requiring businesses to work directly with an agent to understand their premiums and coverage options.

-

- Market Reach: While The Hanover is a solid choice, it may not have the same national presence or breadth of coverage options as some larger insurers like Nationwide or Chubb.

What is General Liability Insurance?

Liability insurance safeguards the policyholder against the risks of being sued and held legally liable for anything, such as bodily injury or damage, negligence, or malpractice. It covers legal costs, settlements, and any other financial obligations that may arise if you are found legally liable for damages. General liability insurance offers a range of protections against liability claims from third parties, including legal defense costs in cases of bodily injury, property damage, and advertising injuries, while excluding employee and performance-related claims.

Liability insurance is very important because it protects against potentially devastating financial losses in case of a lawsuit. Without insurance, one may have to pay directly out of pocket for attorney fees, settlements, and other related expenses, which can financially debilitate them.

Such insurance is necessary for any business, regardless of size, since it protects against impending legal liabilities.

How Can a Liability Insurance Provider Benefit Your Business?

Professional Liability Insurance Financial Protection

Liability insurance can help cover legal fees, settlements, and court judgments, ensuring your business remains financially stable even in the face of a lawsuit.

Business Continuity

With liability coverage, your business can continue to operate without the financial strain that legal issues might otherwise impose. This ensures that day-to-day operations aren’t disrupted.

Small Business Insurance Management

Some policies include coverage for reputation management, helping to mitigate the impact of negative publicity associated with lawsuits or claims against your business.

Peace of Mind

Knowing that you have a safety net allows you to focus on growing your business, exploring new opportunities, and taking calculated risks without fear of financial ruin from unforeseen legal challenges.

Legal Compliance

In some industries, liability insurance is not just advisable but also lawfully required. Ensure you have the right coverage and that your business complies with regulations and industry standards. Read more from our liability insurance guide for 2024!

Dario’s Wrap-Up

The best proper liability insurance providers help keep your business safe. Whether a small start-up or a big corporation, the right coverage makes you better placed to take on business risks. Full cover providers like Nationwide, Hiscox, and Chubb offer various options that differ by industry, adding flexibility in finding the best for your needs. Where liability insurance is concerned, this is not protection but rather an investment into the future of your business.

Frequently Asked Questions

1. What is liability insurance, and why is it important for my business?

Liability insurance protects your business from the financial burden of legal claims arising from accidents, injuries, or damages on your premises or as a result of your operations. It covers legal fees, settlements, and other associated costs, allowing you to focus on running your business without fear of devastating financial loss.

2. How do I choose my business’s best liability insurance provider?

When selecting a liability insurance provider, consider their specific coverage options, customer service quality, financial strength, and industry expertise. It’s also important to assess the ease of obtaining a quote, the claims process, and any additional benefits like risk management services.

3. What are the top liability insurance providers in 2024?

The top liability insurance providers 2024 include Nationwide, Hiscox, Chubb, AllState, Insureon, The Hartford, and The Hanover. Each company offers unique strengths, such as specialized coverage options, excellent customer service, and customizable policies tailored to various industries.

4. Is liability insurance mandatory for all businesses?

While liability insurance is not legally required for all businesses, it is highly recommended. Certain industries or contracts may require liability coverage; without them, you risk significant financial loss from lawsuits or claims.

5. Can liability insurance help with reputation management?

Yes, some liability insurance policies include coverage for reputation management. This helps your business recover from negative publicity associated with lawsuits or claims, which can be crucial in maintaining your business’s public image and customer trust.

6. How much does liability insurance cost for small businesses?

The liability insurance cost varies depending on the size of your business, industry, coverage needs, and the provider you choose. On average, small businesses can expect to pay anywhere from $300 to $1,200 annually for a general liability policy, though prices can be higher for businesses with greater risk profiles.

7. Can I get liability insurance online?

Yes, many providers, such as Hiscox and Insureon, can obtain quotes and purchase liability insurance online. This can be a convenient option for small businesses looking for quick and easy access to coverage.