Perhaps the most pressing question when starting a business is, “How much is insurance on a business cost?” It may really differ a great deal because no two businesses are alike and are faced with a risk factor unique to each. This is why knowing what determines price will help get the best at an affordable price.

Moreover, finding the right policy gives peace of mind in knowing that all your hard work is protected in case of an accident.

So, let’s get into it. We will answer all your questions about how much is insurance on a business costs and provide examples to help you decide what’s right for you. Even if you’re a beginner or a pro, we can help you navigate the basic costs of different types of business insurance.

How Much Is Insurance On a Business Cost: 3 Point Summary

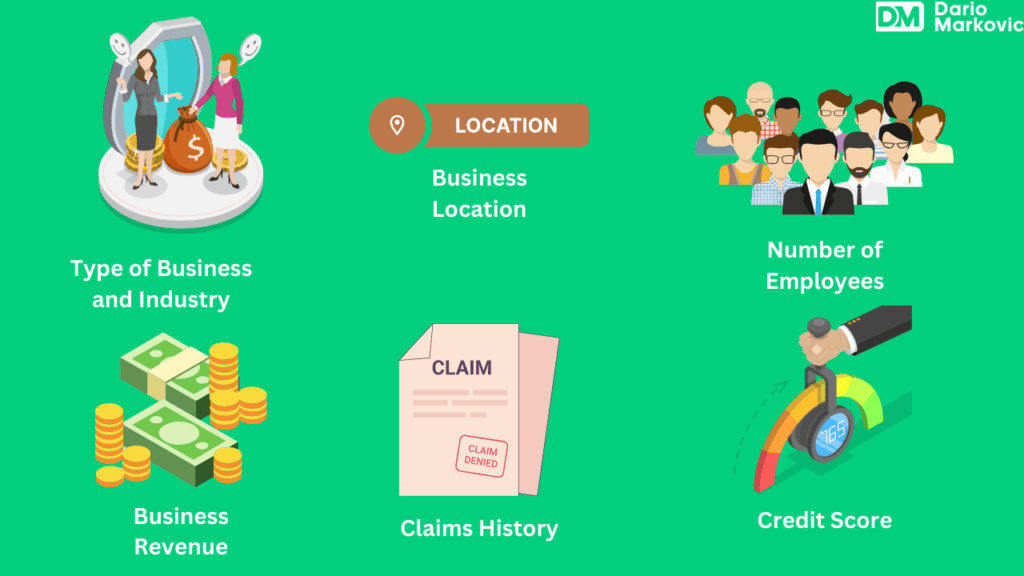

Factors Influencing Insurance Costs: The cost of business insurance is affected by several key factors, including the type of business (higher-risk industries face higher premiums), the business’s location (areas with high crime or natural disaster risks lead to increased rates), and the number of employees (more employees can result in higher workers’ compensation costs)

Types of Coverage: Essential types of business insurance include General Liability, Commercial Property, and Workers’ Compensation. Other important policies include Professional Liability for service providers, Cyber Insurance for data breaches, and Business Interruption coverage to compensate for lost revenue during operational shutdowns

Strategies for Affordable Insurance: Business owners can find affordable coverage by shopping around for quotes, bundling multiple policies for discounts, asking about specific discounts based on risk management practices, adjusting deductibles to lower premiums, and consulting with insurance agents or brokers for tailored advice

Factors That Affect How Much Is Insurance on a Business

A variety of elements impact the price of business insurance. Knowing these is a great first step in understanding the insurance landscape.

Factors That Affect How Much Is Insurance on a Business

A variety of elements impact the price of business insurance. Knowing these is a great first step in understanding the insurance landscape.

Factor 1: Type of Business and Industry

Your business type has much to do with your insurance rate. Higher-risk businesses, like construction or manufacturing, will have higher premiums since the likelihood of accidents happening and subsequently resulting in insurance claims is high. That means more financial risk the insurer is taking on.

Say you are operating a bakery. Since customers come into the store often and may be injured on your premises—perhaps due to a slip and fall—you carry more risks than an accountant or financial advisor who largely interacts with their clients virtually.

Factor 2: Location of Business

This includes the location of your business. Are you in a place with a high crime rate? Is it in a locale prone to natural disasters like wildfires and earthquakes? Then you should expect higher rates. For insurers, those situations represent greater risks.

For example, insuring a beachfront restaurant in Florida—a state frequently hit by hurricanes—will cost much more than an office in a quiet suburban location.

Factor 3: Number of Employees

The size of your workforce is also a factor when deciding how much business insurance costs. With an increasing rate of business growth comes a correspondingly higher risk of employee-related accidents, leading to higher workers’ compensation costs. According to Insureon, most small business customers have 1–4 employees.

This means that, according to the Bureau of Labor Statistics, more than 1 in 10 Americans runs small businesses, and very often, those people hire employees, thereby raising the coverage cost even higher.

Factor 4: Revenue of Business

Just as the number of workers can impact insurance pricing, the amount of money your company brings in each year will, too. It’s a risk vs. reward calculation for insurance companies. Companies that generate more revenue tend to have more significant assets to protect.

Plus, a more extensive operation means more that could potentially go wrong, driving insurance premiums higher.

Factor 5: Claims History

When calculating the cost of business insurance, it’s crucial to consider your past claims. Any lawsuits or prior claims you’ve filed against an insurance company can lead to higher premiums during renewal. By considering this and actively managing your claims, you can be more responsible and in control of your insurance costs.

This is particularly important since research indicates that 40 percent of businesses will file a claim within ten years.

Factor 6: Credit Score

You may not know this, but your credit score comes into play. It’s not only for loans and mortgages. Insurers will be interested since, by federal law, they can check your credit to make their calculations.

It reflects a lot about how responsible and financially stable a business owner is. It might predict future claims in so many ways.

Types of Coverage

The type and amount of coverage chosen impact how much is insurance on a business determinant. Each has its purpose and its associated price tag. In the following sections, we will detail the common types of business insurance one should consider.

Though your exact needs will depend on your business type and location, key insurance policies are available to every business owner. Let’s examine a few of the most commonly selected and what they cover. Hopefully, this will help narrow down exactly how you can best protect yourself and bring you one step closer to understanding how much business insurance costs.

General Liability

General liability insurance is the most basic business insurance, providing financial protection if your company is liable for another person’s injury or property damage. It can protect you from some of the incidents that hurt your bottom line, which include customers getting injured on your premises, ad injuries like libel or slander, and damage while performing operations.

Without it, you’re on the hook for the legal fees or settlement costs. How much does that type of coverage cost? The annual premium can start as low as $200 with providers like Next Insurance, which might be more appealing if you have a startup with a small budget.

On the other hand, providers like CoverWallet may charge more for this type of coverage. However, they often offer a comprehensive package, combining it with other policies like commercial property insurance to provide even greater peace of mind.

Commercial Property

Commercial property insurance, as the name implies, covers your physical space—office, shop, warehouse—and business-owned contents from catastrophes such as fire, storms, vandalism, or theft. It compensates if you must repair or replace those assets due to a covered incident.

Consider the potential loss to your business if, for instance, your office suffered flood or fire damage, and you were solely responsible for all the repair or rebuilding costs.

Workers’ Compensation

Workers’ compensation insurance is likely mandatory (state-dependent) if you have employees. However, it’s also a significant financial safeguard. It covers the medical treatment for employees in case of work-related injuries and their lost wages, thereby protecting your company from potential large financial expenditures.

But do not think of this as something that you will not have to think through thoroughly for yourself and your employees. Workers’ compensation policies protect the company legally as much as possible against potential lawsuits.

Professional Liability

This is exactly what many consultants, advisors, freelancers, and professional service providers need. This type of insurance is also known as Errors and Omissions insurance. Professional liability insurance cost covers your business if a client files a lawsuit against your business alleging mistakes, omissions, negligence, or malpractice.

Professional liability insurance should be seriously considered if you are a relationship therapist, a financial planner recommending retirement investments, or a contractor offering construction advice.

Commercial Auto

Like your personal car, your company vehicle (or any vehicles used for business purposes) also needs insurance to protect against collisions and damage. But instead of purchasing personal auto insurance, which likely doesn’t cover vehicles used commercially, get commercial auto insurance.

Additionally, suppose your business has a rideshare component (think of employees making deliveries using personal vehicles). In that case, it may make more financial sense to add rideshare insurance onto an employee’s personal policy than to get them a separate commercial auto policy, because those often require stricter qualifications. Plus, a rideshare policy addon will increase an existing policy only $5–$20 each month, which helps lower overall company insurance costs.

Business Interruption

Think of business interruption coverage as an extension of your property policy. It kicks in after an incident that causes your company to shut down operations for a period. If there’s a fire in your shop, you’ll be facing not only the cost of rebuilding or repairing your building, for instance.

Business interruption coverage compensates you for the revenue your business would’ve earned during the rebuilding process while it’s shut down, which protects you against financial disaster. Here’s an overview of this type of insurance.

Cyber Insurance

Cyber insurance can be likened to any other form of insurance taken by an organization or an individual to prevent him from suffering any loss due to any cyber incident. Most of this policy accrues payable after a cyber incident, including expenses made on data breaches such as notifications to the affected customers, provision of credit monitoring services, and legal fees.

Cyber insurance can also include coverage for ransom payments an organization is forced to make in the event of a ransomware attack and the income loss due to a cyber attack’s disturbance of normal business operations. The policy limits will compensate legal and regulatory expenses and public relations costs for the reputation management of a firm arising from a cyber incident.

Cyber insurance has become a critical shield in the face of the rising number of cyber attacks. It significantly relieves the financial burdens that follow cyber incidents, ensuring that business entities and individuals can recover and maintain their reputations. More importantly, it allows them to continue their business operations without challenges, instilling a sense of reassurance and confidence.

How To Find Affordable Coverage

One of the things business owners want to know most is this: How can you get affordable business insurance? There are various tips and tricks you can use when seeking policies.

Shop Around and Compare Quotes

This should be one of your first steps when evaluating your options. Don’t just settle for the first insurer you find. Different companies use unique calculations and assess risks in varying ways, which leads to different quotes. This is where your effort is worth its weight in gold. Take some time to get a variety of business insurance quotes to find the one that’s most affordable.

Also, keep in mind: Some states have greater access to insurance options than others. That could work in your favor as it often generates more pricing competition, resulting in better deals for business owners.

Bundling

Oftentimes, you’ll need more than one type of coverage. You can save money on small business insurance costs by asking your agent or broker if they offer package discounts, sometimes called business owner’s policies (BOPs). For example, BiBerk has a starting price of $500 per year for BOP coverage.

This packages together some of the most common types, typically general liability and commercial property coverage. If you were to buy them separately, you’d pay much more. If your agent or broker offers this type of package deal, it may be the right solution for your company.

Ask About Discounts

Insurance providers, like those specializing in small business insurance, might offer you special pricing on coverage for having specific business practices in place. They could be tied to building safety and security or risk management practices like employee training programs or having a business continuity plan.

There also might be special savings available based on factors such as company structure or being a member of a professional association. For example, companies may get a break on rates if they’re a corporation rather than a sole proprietorship. You won’t know if you don’t ask, so be sure to speak up.

Deductible Adjustment

Another tactic in reducing insurance premiums is selecting a higher deductible when choosing your policy. It means paying a larger upfront amount before your coverage kicks in if there’s a claim. Although this strategy shifts more initial costs to you, it’s worth considering. You will pay lower monthly or annual costs in the long run.

However, before choosing this tactic, be honest with yourself about whether you could afford a bigger financial outlay if your business faced an incident requiring insurance.

Consult with an Agent or Broker

If the whole process seems overwhelming, an experienced professional can offer personalized advice and help you get the best rates. Working with an insurance agent or broker is often the right move for a small business owner, according to the experts.

It might feel counterintuitive because agents and brokers usually charge fees, but you might save even more money in the long run. They can guide you through a range of choices and complex scenarios—from how much business insurance to choose, what coverage makes the most sense for your company’s situation, to which providers will offer the most affordable rates. Their in-depth industry knowledge and experience will point you in the right direction.

Dario's Takeaways

You want to consider many factors and scenarios when deciding how much is insurance on a business insurance to buy. Taking up all of this at one time can be tremendous and mind-boggling, so take your time learning about your options and talking to the right people.

Talking through things with an experienced agent or—better yet—a company like The Hartford or a brokerage service like CoverWallet sheds light along the way ahead.

This will ensure the right amount of coverage at the correct price. This brings comfort to you to be assured that your company is protected while running and busy with the company.

FAQ

Each situation will be unique, but many companies choose to get general liability coverage to protect against injuries or damage to others’ property, particularly as a starting point. Consider that as the first policy you take out because you can often find affordable annual premiums.

After that, your specific situation will guide you. Property and auto coverage are common. If you hire workers, be aware you will probably need workers’ comp based on your state. A lot also hinges on your company structure. The legal regulations vary according to the differences between sole proprietorships, partnerships, corporations, or LLCs.

Plus, the nature of your business dictates which policy might offer the most useful financial protection. For example, contractors should get professional liability coverage, whereas retail business owners should consider business interruption coverage. Consider comparing your options to evaluate what fits your needs.

For example, with a $5 million policy, how much a $1 million dollar business insurance policy costs is going to depend on industry, coverage, risk, etc. Therefore, the only way to truly answer this will be to get quotes from top-rated insurers for your specific needs. Some average annual premiums are listed in this in-depth guide about business insurance, which may give you an idea of what a \$1 million general liability policy would cost.

Keep in mind that this is based on its customers and can’t definitely foretell what any given business owner might pay. In addition, note that other policies, such as property, commercial auto, or workers comp, also have premiums that vary.

There’s no single answer because premiums depend on various factors like the types of coverage purchased, location, industry, claims history, etc. For instance, it is pretty much a safe bet that even the best small business insurance will charge you a great deal for $5 million in coverage compared to $1 or $2 million.

It’s because the higher the limit, the higher the payout the insurer may face, say, $5 million in this case. That risk is baked into the prices.

The cost of business insurance is affected by several factors, including the type of business (higher-risk industries face higher premiums), location (areas with high crime or natural disaster risks lead to increased rates), number of employees (more employees can increase workers’ compensation costs), annual revenue (higher revenues often mean higher premiums due to greater assets at risk), claims history (previous claims can lead to increased rates), and credit score (a lower credit score may indicate higher risk to insurers).

Essential types of business insurance include:

- General Liability Insurance: Covers injuries or damages for which your business may be liable.

- Commercial Property Insurance: Protects physical assets from disasters like fire or theft.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Professional Liability Insurance: Protects against claims of negligence or errors in professional services.

- Cyber Insurance: Covers losses related to cyber incidents, including data breaches and ransomware attacks.

To find affordable business insurance, consider these strategies:

- Shop Around and Compare Quotes: Obtain multiple quotes from different insurers to find the best rate.

- Bundle Policies: Look for package deals that combine various types of coverage, often at a discounted rate.

- Ask About Discounts: Inquire about discounts for implementing safety measures or being part of professional associations.

- Adjust Deductibles: Opt for a higher deductible to lower premium costs, but ensure you can afford the deductible in case of a claim.

- Consult an Agent or Broker: Seek professional advice to navigate options and potentially save money in the long run.